|

The Economist (or more specifically, Lexington) is insufficiently left-wing for Brad Setser:

Lexington could not find any public intellectuals (or ideas) from the center, the center-left or the left worthy of mention…I would say that the interesting policy debate on globalization currently is found on the left, not the right…The left takes seriously idea that the US needs to find ways to share the benefits of globalization more broadly and address growing concerns about economic insecurity and income volatility.

These are more homilies than serious ideas, but the notion that this burden necessarily falls on the United States goes to the heart of Brad’s misdiagnosis of issues such as global imbalances. Whatever institutional short-comings might be found in the US and other Anglo-American countries, it is the rest of the world, not the US, that needs to get its house in order.

posted on 29 March 2006 by skirchner in Economics

(0) Comments | Permalink

From The Australian:

According to a report commissioned by the Property Council of Australia, government charges associated with a typical house and land package had risen an average of $77,000 since 2000.

In southeast Queensland’s Redlands Shire those charges had soared 583 per cent in five years to $135,799, while government charges on a house and land package in Adelaide rocketed 331 per cent to $53,003.

But the problem was most pronounced in Sydney’s northwest where 35 per cent - or almost $200,000 - of the price of a new home was eaten up by government charges.

In comparison the cost of the land was only $116,667…

In the five years to 2005 government costs associated with buying a house and land package in northwest Sydney grew 197 per cent to $198,670.

In Melbourne and Canberra those costs grew 146 per cent to $91,135, and 237 per cent to $108,011, respectively.

posted on 28 March 2006 by skirchner in Economics

(0) Comments | Permalink

We have previously noted the under-reported business investment boom in Australia, which has taken the investment share of GDP to post-war record highs and which largely explains the widening in Australia’s current account deficit. An even lesser known phenomenon is the fact that Australia is increasingly a net exporter of direct investment capital. Australia is one the biggest suppliers of foreign direct investment capital in the US, a phenomenon noted in this LA Times story from 18 March, reproduced in today’s SMH:

Last year Australian companies sank $US6.1 billion into US real estate, up from $US3.5 billion the previous year…

Real estate isn’t the only area benefiting from Australian investors, who have been enjoying a relatively strong currency and 14 years of growth. Macquarie has also sunk money into major US infrastructure projects, including toll roads in San Diego, Chicago and Washington.

This week, Australia’s Woodside Petroleum unveiled a plan to build a liquefied natural gas terminal off the California coast and BHP Billiton announced similar plans for a floating LNG facility farther north.

Ben Thornley, a New York investment specialist with the Australian Government, said US investment in Australia also was increasing, spurred by the recent completion of a bilateral trade pact.

But he said the US still had the stronger allure, with at least “100 billion Aussie dollars” seeking a home in the US at any given time.

“There’s more money flying out of Australia than going the other direction,” he said.

Some US investors are bypassing Wall Street and heading straight to Australia.

In 2004 Tishman Speyer, the private New York developer, raised $400 million through a property fund it listed on the Australian Stock Exchange.

Rob Speyer said it was much easier to raise capital in Australia than in the US.

posted on 27 March 2006 by skirchner in Economics

(0) Comments | Permalink

The New Zealand economy contracted by 0.1% in Q4 and averaged 0% growth in the second half of 2005. The data suggest that NZ was heading into recession before 2006 even began. Sadly, these are the sort of macro outcomes to be expected when central bank governors give too much weight to concerns about external imbalances and house prices.

posted on 24 March 2006 by skirchner in Economics

(0) Comments | Permalink

James Dorn on the origins of China’s national saving glut:

Of the world’s top 10 biggest trading nations, only China has extensive capital controls. Sure, current-account transactions, or trading in goods and services, are liberalized. But Chinese citizens are barred from investing overseas, interest rates are heavily regulated and domestic stock markets are limited mostly to state-owned enterprises.

China pays a high price for such controls, which distort investment decisions and misallocate capital. Ordinary Chinese suffer too. Denied the right to seek higher returns overseas for their hard-earned savings, they have no choice but to take their chances with poorly regulated domestic investments. And that, in turn, helps explain why China’s savings are so high—and why the much-discussed U.S.-China trade deficit remains intact.

posted on 23 March 2006 by skirchner in Economics

(0) Comments | Permalink

New Zealand’s Q4 current account deficit is expected to come in at around 9% of GDP when it’s released tomorrow. The fact that a small open economy like NZ can run such a large deficit should be reassuring. It should also not be surprising. RBA Governor Macfarlane has noted that Singapore ran current account deficits averaging 15% of GDP for a decade, in the context of a much less flexible exchange rate and capital account regime.

Alan Wood notes that ‘the bigger risk is that the RBNZ has raised rates to a level that turns out to be economic overkill,’ an argument we have also made on these pages. The whole point of having a floating exchange rate and open capital account is that monetary policy does not need to concern itself with considerations of external balance or prop up the currency, yet the current account has featured heavily in the RBNZ’s policy discussion of late. As Australia’s experience in the late 1980s and early 1990s demonstrates, external imbalances only become scary when they become a preoccupation of policymakers.

posted on 22 March 2006 by skirchner in Economics

(7) Comments | Permalink

Michael Mandel notes some of the problems with proposals for a prediction registry, referencing two of our favourite targets, The Economist magazine and Brad & Nouriel.

posted on 22 March 2006 by skirchner in Economics

(0) Comments | Permalink

Desmond Lachman continues to trash the AEI’s free market credentials:

If ever over the past sixty years the global economy needed an IMF to effectively discharge its original mandate of helping to safeguard the international exchange system, it has to be now at a time of such large and disturbing global economic imbalances.

There was a time when conservative think-tanks criticised the IMF as a redundant institution in the post-Bretton Woods era. The IMF’s former role in helping countries with the balance of payments problems that emerged under fixed exchange rate regimes was no longer needed once the industrialised world moved to a system of floating exchange rates and open capital accounts. Problems have remained in emerging market economies with fixed exchange rate regimes, but even there, the IMF has played a less than constructive role, as Lachman himself notes. Indeed, reserve asset accumulation on the part of East Asian central banks is partly driven by their view that IMF intervention in the East Asian financial crisis of 1997-98 was a failure.

The argument for doing away with the IMF is compelling, yet growing global ‘imbalances’ have many people arguing for a revival of Bretton Woods era institutions. This is ironic, since it was only under the Bretton Woods system that global imbalances were a serious problem. It is even more ironic that these calls now come from conservative think-tanks. It demonstrates that even they fail to comprehend the free market case for taking a benign view of global imbalances.

Lachman’s argument that global imbalances promote protectionism is quite ridiculous. It is in fact those who fret about global imbalances who are doing the most to promote protectionist sentiment, by promoting the view that these imbalances are somehow a problem requiring a solution.

posted on 21 March 2006 by skirchner in Economics

(0) Comments | Permalink

Ben Bernanke, arguing against the proposition that foreign official reserve asset purchases are a significant determinant of US interest rates:

The performance of Treasuries relative to that of other fixed-income instruments also argues against a dominant influence of foreign official portfolio decisions on long-term rates. If foreign official holdings of Treasuries were the source of the decline in their yields, then we would expect to observe increased spreads between yields on Treasury securities and the returns to other types of debt less favored by foreign official holders. But we have not seen a significant widening of private yield spreads relative to Treasuries—quite the contrary—and, as I noted earlier, yields in other industrial economies have fallen as well, in many cases by more than U.S. yields. A reasonable conclusion is that the accumulation of dollar reserves abroad has influenced U.S. yields, but reserve accumulation abroad is not the only, or even the dominant, explanation for their recent behavior.

posted on 21 March 2006 by skirchner in Economics

(0) Comments | Permalink

Andy Xie, Morgan Stanley’s house mercantilist, recommends that China resort to central planning to combat higher iron ore prices:

Without government involvement, China’s industries cannot organize to negotiate down the ore price, because the industry is so new and fragmented. Limiting import prices is a good choice, I believe. If the negotiations with the major suppliers do not work out, China’s government should just dictate import prices for the whole year.

This would be a breach of China’s obligations under the WTO, but that doesn’t seem to bother Xie. He goes onto argue:

If China does unilaterally limit import prices, it would not affect supply that much. The ore producers have huge profit margins and have to sell. To whom would they sell without selling to China?

Well everyone apart from China for a start. The desperation of Chinese steel producers is already evident from this story:

Chinese trading companies are surfing a local version of eBay, Alibaba, to scour the world for an increasingly state-controlled resource—iron ore.

Small steel mills, desperate to find iron ore from Brazil, India, Indonesia or New Zealand, can find it on Alibaba, China’s top online business-to-business Web site, which is backed by Yahoo Inc.

Some of the 237 offers available on Friday included photos of a lump of the ore used to make steel.

“We use the Internet as an extension of our services, to let more people know what we have,” said Sun Gongmin, who handles Internet marketing for Beijing Hero Trade Co. “We only started posting iron ore late last year. Before that we’d been pretty successful with rugs.”

“A lot of people have contacted us already, mostly other trading companies helping their clients source a few thousand tonnes here or there. We’re basically just the middlemen.”…

the Shanghai Huozhiyao Import Export Trade Co. offers Indonesian spot ore at $67 (38 pounds) a tonne, illustrated by a photo of a tropical shoreline. Brazilian ore is $69 a tonne.

Spot Indian iron ore in Chinese ports is now valued around $72 to $73 a tonne, traders said. Brazilian ore sold on a term basis is now valued around $67 a tonne, cost and freight.

posted on 18 March 2006 by skirchner in Economics

(1) Comments | Permalink

A research paper published under the auspices of the Sydney Futures Exchange seeks to highlight trading opportunities for the global CTA and hedge fund communities in relation to Australia macroeconomic data. The paper examines price volatility in selected futures contracts around various macroeconomic releases.

The results confirm previous studies in both the Australian and US contexts suggesting that the monthly employment numbers have the biggest impact on bond futures prices. In part, this just reflects the volatility in the employment numbers themselves, which are subject to very large standard errors. Outside of consensus employment numbers are thus more common than for other releases.

This still begs the question as to why the market reacts so strongly to a release that is relatively noisy and is widely thought to be a lagging indicator of activity. My own behavioural finance explanation for this is that the monthly employment numbers are one of few indicators that everyone thinks they understand, because they have a fairly unambiguous economic interpretation: employment up, economy up; employment down, economy down. Yet leading indicators of employment widely used in forecasting imply that this information is already in the data, for those who care to look.

posted on 16 March 2006 by skirchner in Economics

(2) Comments | Permalink

Most analyses of the cost of the war in Iraq fail to take adequate account of the relevant counter-factuals. This paper by academics at the University of Chicago GSB is a notable exception. They conclude that not only are the costs of intervention on a par with the pre-war containment strategy, but that the war will lead to large improvements in the welfare of the Iraqi people.

(via DBRB)

posted on 16 March 2006 by skirchner in Economics

(1) Comments | Permalink

Back in January, I argued in Business Week that the BoJ would probably relax its previous opposition to an inflation target, in association with the end to quantitative easing and a return to an official interest rate as the BoJ’s main operating instrument. In the event, the BoJ moved a month sooner that I expected. But the BoJ’s ‘New Framework for the Conduct of Monetary Policy’ falls well short of fully fledged inflation targeting.

The new framework defines an inflation rate of 0-2% as desirable over the medium to long term, with the central tendency of BoJ policy board’s view of price stability said to be 1%. As I noted in the article in Business Week, this is consistent with Japan’s long-run average inflation rate. The BoJ says that it ‘will review its basic thinking on price stability, and disclose a level of inflation rate that its Policy Board members currently understand as price stability from a medium to long-term viewpoint, in their conduct of policy.’ This is something that will be ‘reviewed annually’ and the BoJ will ‘conduct monetary policy in the light of such thinking and understanding,’ but otherwise there is no explicit link between inflation outcomes and monetary policy. The inflation target thus does not limit the BoJ’s policy discretion in any way. While announcing an inflation rate deemed consistent with price stability might help in anchoring long-term inflation expectations, it will do little to condition expectations for the near term path of inflation or interest rates. The BoJ’s experience with the zero bound and deflation shows that expectations management is essential to the effective conduct of monetary policy. The BoJ’s new policy framework is a missed opportunity.

posted on 15 March 2006 by skirchner in Economics

(0) Comments | Permalink

The FT interviews the (thankfully) retiring editor of sister publication, The Economist:

One of his most embarrassing covers, according to Emmott, was in March 1999, about a subject that should have been simple Economist territory: the price of oil. It had its roots in a lunch with an oil company executive, where everybody started musing that, with the oil price at $10, what would happen if it fell to $5? A cover saying that the world was drowning in oil, and noting the possibility of a fall in the oil price, duly appeared. But before the end of the year the price had more than doubled. “It was most embarrassing,” he says candidly.

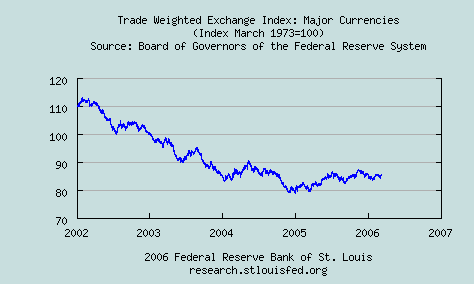

I could suggest a few others. There was also that 2 December 2004 leader on “The disappearing dollar” that said “the [US] dollar could tumble further and further.” The end of 2004 proved to be a major cyclical low for the USD. Contrarian indicators don’t come much better.

posted on 11 March 2006 by skirchner in Economics

(0) Comments | Permalink

Alan Wood, on the governance of the Future Fund:

Choosing the members of the curiously named board of guardians is up to the responsible ministers - currently Peter Costello and Nick Minchin. (Pursued in senate estimates on the legal standing of the term “guardian” compared with the more familiar term “trustee”, the Government’s Senator George Brandis, a barrister, said the only common law about guardians was in relation to children and the insane.)

The process is much the same as the one that led to the appointment of Rob Gerard to the Reserve Bank board.

Governance issues aside, Wood gets to the heart of why the Future Fund is such a bad idea:

Unfunded public service superannuation liabilities are not a problem.

The size of the liability is not large relative to future budgets and will steadily decline now the Government has closed off most of its defined benefit funds. And there is a strong economic argument for not using budget surpluses to fund these liabilities, put by economist Nicholas Barr from the London School of Economics, an international authority on pension funds. Barr’s basic point is simple but profound - what matters for an ageing population is not how much money it has put away, but availability of goods and services to satisfy its demands. That is, the level of output.

“The point is central,” Barr says. “Pensioners are not interested in money (that is, coloured bits of paper with portraits of national heroes), but in consumption - food, clothing, heating, medical services, seats at football matches, and so on. Money is irrelevant unless the production is there for pensioners to buy.”

Former treasury secretary Ted Evans made the point this way: “Let’s be clear that the ability of future generations, and their governments, to meet the needs of their day will be entirely dependent on the size of the economy they command at the time. Hence the greatest contribution that today’s population can make to the living standards of future generations is to ensure that today’s policies are directed towards maximising future GNP.”

Evans suggested the best way to do this wasn’t through an inter-generational fund like the Future Fund, but by leaving the tax revenue in the hands of taxpayers to spend as they see fit, that is, tax cuts.

Putting surpluses in the Future Fund amounts to increasing tax on this generation of taxpayers. Does increasing the tax burden over the next few years really sound like the best way of increasing GDP in, say, 2020? Hardly.

CIS has a much better idea.

posted on 11 March 2006 by skirchner in Economics

(0) Comments | Permalink

Page 88 of 111 pages ‹ First < 86 87 88 89 90 > Last ›

|