|

Barry Ritholtz points to one of our favourite contrarian indicators, but one which is giving mixed signals. Do we run with the bear on the cover, or the inside story which urges us to ‘stare down the bear’? Perhaps The Economist has at last recovered some semblance of its former intellectual modesty (but I’m staying bearish on that question).

posted on 26 May 2006 by skirchner in Economics

(0) Comments | Permalink

The Fed-bashing brigade often claim that the Fed is out of step with other central banks in not targeting asset prices, with the BoE and RBA in particular said to be more sympathetic to the idea. This is a misreading of the way in which these central banks think about asset prices, as this speech from the BoE MPC’s Paul Tucker suggests:

we just do not know enough about the determination of asset prices – especially of risk premia – to have much of an idea about what price to target. Big moves in asset prices do occasionally occur because of changes in the underlying economic fundamentals. We could not be relied upon to distinguish between those benign changes and bubbles. But even if we could, I don’t see how in practice we could use our single instrument (the overnight interest rate) to target both consumer price inflation and asset prices – especially when one remembers that there are lots of different asset prices and that questions of disequilibria about them may run in different directions.

In 2002-03, some of us on the MPC voted to maintain an unchanged policy rate rather than cut partly on the grounds that, by stoking the embers under household debt and house prices, too great a risk would be taken with future output and, most important, inflation variability. Speaking for myself, that was directed at avoiding policy settings that, on balance, could have increased uncertainty about demand conditions and inflation in the future, and complicated the operation of policy down the road, not on some spurious aspiration of steering asset prices along some (unknowable) equilibrium path.

posted on 26 May 2006 by skirchner in Economics

(0) Comments | Permalink

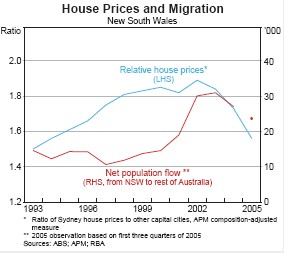

The ABS has released its March quarter house price indices, which continue to show divergence between house prices in Sydney and the other capitals. As we have noted previously, the heterogeneity in capital city house price inflation argues strongly against attempts to explain house prices with respect to national factors, such as fiscal and monetary policy. It also suggests that it is the economy that drives house prices, rather than the other way around. House price inflation is strongest in those states benefiting most from the commodity price boom, a development exogenous to the Australian economy.

The RBA’s most recent Statement on Monetary Policy noted the role of divergences in regional economic performance and inter-state internal migration as a driver of relative house price movements.

posted on 25 May 2006 by skirchner in Economics

(5) Comments | Permalink

A Wall Street lawyer tries to auction his social security entitlements on Ebay:

Wojcik says he’s not breaking any laws or securities regulations.

“It’s not a security; it’s a person-to-person contract at a negotiated price, provided it’s allowed,” he said.

Wojcik, also a securities lawyer, believes he’s avoiding any Securities and Exchange Commission violations by including boilerplate clauses warning of “risk factors” in his deal, such as that of being prohibited by the government from ever transferring his future checks, or his death.

Ebay took a different view, yanking the auction. This is unfortunate, since it might have yielded some insight into the expected future value of social security benefits. Given that the social security system is expected to be insolvent at reasonable horizons based on current policy settings, one suspects that these benefits would be heavily discounted.

Meanwhile, the NYT discovers that Harvard women produce more valuable eggs than Colombia women:

Q. At Columbia University, there are ads in the student newspaper offering to pay tall blondes with high SAT’s $8,000 to $20,000 for eggs to be used by infertile couples. Is this a good price?

A. Hmm. I think the price for Harvard eggs is higher, around $25,000. There have been ads offering even $50,000 and $100,000 for “exceptional eggs” though no one’s ever come forward to say they’ve gotten that much.

(via MR and Ben Muse respectively)

posted on 25 May 2006 by skirchner in Economics

(0) Comments | Permalink

David Altig, on why the USD is the currency you run to, not from:

to anyone waiting for the greenback slaughter, I have one question: If, heaven forbid, the global economy goes south, who ya gonna call?

posted on 24 May 2006 by skirchner in Economics

(0) Comments | Permalink

The federal government is running a negative net debt position and budget surpluses of 1% of GDP over the forward estimates. Yet the consensus view among the commentariat seems to be that the Commonwealth should be hoarding even more revenue it doesn’t need. Peter Hartcher argues that given Australia’s current account deficit:

If Peter Costello has the option to allow any unexpected revenues in the coming year to be saved as surplus rather than spent, he should take it.

This argument assumes that there would be no offsetting private sector response to increased public saving, leaving national saving unchanged. The surplus is just a substitution of public for private saving. The domestic saving-investment imbalance that drives the current account is not a function of inadequate private sector saving, but the record investment share of GDP.

To argue for a contractionary fiscal policy to lower the current account deficit is equivalent to arguing that the private sector investment boom in Australia is mistaken and should be curbed. In fact, the investment boom is essential if Australia is to fully capitalise on the opportunities presented by the terms of trade boom.

posted on 19 May 2006 by skirchner in Economics

(0) Comments | Permalink

Bogleheads and Vanguard Diehards can now hear their master’s voice at The Bogle Blog.

posted on 18 May 2006 by skirchner in Economics

(0) Comments | Permalink

James Hamilton on commodity price inflation:

One challenge for either the monetary inflation or the speculative bubble view of the commodity price movements is the fact that there is such diversity, with some commodities going up a great deal and others not at all. Indeed, these differences across commodities are actually much bigger in magnitude than the average movements common to them all. Although not entirely discounting the potential role of monetary or speculative factors, I’m therefore inclined to try to interpret much of the relative price movements as resulting from the same factors that have always made commodity prices much more cyclically sensitive than other prices. Specifically, the long lead times in production and short-run demand and supply inelasticity mean the price can be particularly sensitive to demand fluctuations. A broad increase in the level of economic activity can thus lead to a broad increase in the relative price of a particular group, though with huge differences across items reflecting the particular factors of supply and demand in each market.

Supply and demand determining prices? Who would’ve thought?

posted on 17 May 2006 by skirchner in Economics

(2) Comments | Permalink

Alan Wood continues the education campaign:

Why this obsession with interest rates? You could be forgiven for thinking the only role for fiscal policy is to hold them down. John Howard and Costello actually do think this, so they can hardly complain if others view their budgets through the same lens.

In fact, not long ago Costello was fending off calls for tax reform by warning it could drive up interest rates. However, if the RBA does raise rates again, as it may, it won’t be because of the budget. Costello will only have himself to thank if he gets the blame.

If he wants to avoid this fate, the Treasurer would be well advised to stop rushing to hold a press conference every time the RBA puts rates up. It associates him with the decision. He should let the RBA get on with its job and shut up.

posted on 17 May 2006 by skirchner in Economics

(1) Comments | Permalink

Treasury Secretary Ken Henry addresses some fiscal policy misconceptions in the traditional post-Budget address to ABE:

Clearly fiscal policy is relatively tight – especially by international standards. Should it be tighter? Some think it should, because there is the potential for the terms-of-trade to fall sharply and for income growth to slow. As I have noted, we have already taken out some insurance for this eventuality through our projection assumptions. And while this insurance does not fully unwind the increase in commodity prices, it is substantial, with nominal GDP projected to grow at a rate a full percentage point below its longer term average.

But there are other metrics for ascertaining the suitability or otherwise of the stance of fiscal policy, and these relate to the behaviour of the real economy. Over the recent period, the real economy has been growing at around trend, with output close to full capacity. Furthermore, we have had no significant increase in inflation in this period – no rapid acceleration in prices – with little change in monetary policy settings. It is far from obvious that an alternative fiscal policy approach would have generated superior macroeconomic outcomes.

Some of the criticism of the fiscal strategy appears based on a couple of misconceptions. Let me quickly address those. Having a medium-term fiscal framework does not imply there will only be fiscal surpluses in the future even if the recent increase in commodity prices turns out to be persistent. Importantly, it also doesn’t imply that there can never be deficits. And it does not presage the death of discretionary fiscal policy, as has been suggested by some commentators.

There is an interesting discussion of the long-run implications of recent gains in Australia’s terms of trade.

Liberal MHR Malcolm Turnbull also gives his take on the Budget:

the budget did not target childless, 58-year-old lesbian poets.

posted on 16 May 2006 by skirchner in Economics

(2) Comments | Permalink

At the end of March, we criticised Nouriel Roubini’s forecast of a currency and financial crisis in Australia and New Zealand. Proving his value as a contrarian indicator, Roubini’s post on 28 March coincided exactly with the 2006 lows for both AUD-USD an NZD-USD, which then proceeded to rally strongly.

Roubini now argues:

Some critics naively misunde[r]stood my blog as implying that all the countries in my list risked the kind of severe financial crisis that was, at that time, hitting Iceland. Obviously I did not mean that Australia or New Zealand risked a severe financial crisis.

This qualification is far from apparent from his original post. Indeed, it is Roubini who shows signs of naivety in failing to appreciate institutional characteristics of the Australian and NZ economies and financial markets that we have highlighted on this blog on previous occasions, which make a financial crisis due to exchange rate depreciation laughably improbable.

From his latest post, however, it appears that doomsday has merely been postponed:

expect meaningful downward pressures on the Aussie dollar and the New Zealand Kiwi. Such depreciation - given the overall sounder fundamentals - will not lead to the same serious financial distress that emerging market economies with current account deficits (and the even more severe distress that EMs with twin deficits and other financial vulnerabilities) will experience. But it will not be an easy ride for these two currencies and their markets either.

So apparently we are dealing with only a difference of degree rather than kind. Again, this distinction was far from evident in Roubini’s original post. He has also yet to reconcile all this with his bearishness on the USD. As we argued previously, it is a little difficult for both the US and Australia to experience a currency crisis simultaneously, since this implies that the AUD-USD and NZD-USD exchange rates should be relatively stable. Hardly the makings of an Australian or NZ currency crisis.

It is pleasing to see Nouriel at least qualify his previous post. The main flaw in Roubini’s analysis is the way he persists in applying the Asian financial crisis paradigm that made his reputation in the late 1990s as an all-purpose analytical framework, regardless of the institutional realities of the countries in question. It is a framework that doesn’t even fit emerging Asia anymore, much less Australia and the United States. It’s time for Nouriel to get a new shtick.

posted on 16 May 2006 by skirchner in Economics

(0) Comments | Permalink

Alan Wood still gets it:

A REMARKABLY popular view in markets and elsewhere is that the budget’s tax cuts and spending will drive the Reserve Bank to put up interest rates because of their effect on inflationary pressures in the economy.

Remarkable because it flies in the face of what we have been told by the man who decides monetary policy, Ian Macfarlane. Two years ago, again last year, and again now we have been told by market (and media) analysts the budget tax cuts will drive up interest rates.

Over this period the official cash rate has increased twice - by 25 basis points in March 2005 and another 25 basis points this month. Neither of these rises have had anything to do with tax cuts or fiscal policy more generally.

How do we know? Because the RBA governor explicitly denied any connection with the first rise and has laid out a formula for the relationship between fiscal policy and interest rates that makes it clear he would also deny any connection between the latest rate rise and tax cuts.

And Wowser Ross still doesn’t:

The trouble with it, however, is it ignores the “counterfactual” (what would have happened had you not done what you did) and thus ignores the opportunity cost of Mr Costello’s decision to spend as much this week as he did.

If Mr Costello had spent or given away not one extra cent in the budget, the surplus would have risen from $14.8 billion (or 1.5 per cent) in the old year to $22.4 billion (2.2 per cent) in the new year.

Wowser Ross doesn’t tell us what a government with a negative net debt position is supposed to do with a budget surplus of 2.2% of GDP. Dump it into the Future Fund? Even if we grant Ross his ridiculous counterfactual in which the government hoards even more revenue it doesn’t need, the numbers involved would not yield a significant impact on monetary policy.

Terry McCrann (no link, but see today’s Australian) is appropriately dismissive of the notion that the budget balance has anything to do with the determination of official interest rates. As McCrann notes, fiscal policy is a movable feast and the budget numbers are only as good as the next policy announcement or shift in parameter estimates, rendering Gittins’ counter-factual completely arbitrary.

posted on 13 May 2006 by skirchner in Economics

(0) Comments | Permalink

Updating the numbers from the previous post, the 1988-89 and 1989-90 underlying cash surpluses are now both put at 1.7% of GDP, compared to an estimated 1.5% of GDP for 2005-06. The high interest rates of the late 1980s were thus associated with the strongest budget surpluses as a share of GDP since 1973-74 and still stronger than any Peter Costello has delivered.

The budget surplus falls to 1.1% of GDP in 2006-07 and is essentially unchanged after that, yielding a fiscal impulse from the budget of 0.4% of GDP.

Alan Wood gets it:

wouldn’t all this tax cutting and spending force the Reserve Bank to put up interest rates again?

The answer is an unequivocal no. Why not? Because what matters to our central bankers, as Governor Ian Macfarlane has explained ad nauseam, is the budget bottom line…

As a per cent of GDP the size of the surplus is forecast to be 1.5 per cent in 2005/06 and 1.1 per cent in 2006/07.

This implies a stimulatory change, using the Macfarlane rule of thumb, of 0.4 per cent of GDP—too small to be even a blip on the RBA’s radar screen.

And, if the experience of Costello budgets is a guide, the forecast surplus of $10.8 billion for 2006-07 will turn out to be a substantial underestimate.

In other words, the actual swing in the surplus is more likely to be mildly contractionary, rather than mildly expansionary.

Ross the Wowser doesn’t:

it’s by spending our tax cuts that we risk adding to inflation pressure and making the Reserve Bank want to raise rates further.

It’s likely that part of the reason for last week’s increase was the Reserve’s knowledge that a tax cut was coming, but I doubt it was expecting anything half as big as what we got. We now have budgetary policy and interest-rate policy pulling in opposite directions - not a recipe calculated to minimise the risk of further rate rises.

Somehow, I don’t think Peter Costello is too worried on that score. And since Ross thinks money makes you unhappy anyway, why would he care?

posted on 10 May 2006 by skirchner in Economics

(8) Comments | Permalink

Tonight’s federal budget has the usual suspects (that means you, Chris Richardson) lining-up to tell us that any fiscal stimulus, whether in the form of tax cuts or new spending, will put upward pressure on interest rates. This would come as news to RBA Governor Macfarlane, who has told the House Economics Committee on at least two occasions that fiscal policy has not been a significant influence on monetary policy in recent years.

What made the government’s claims about interest rates during the last federal election campaign so silly was that the 17% mortgage interest rates of the late 1980s were in fact associated with much larger federal budget surpluses as a share of GDP than we have now. The 1988-89 underlying cash surplus was 1.8% of GDP. The best Peter Costello has engineered to date is an estimated 1.1%.

If anything, we would expect strong budget surpluses to be associated with higher interest rates, because both are a reflection of the strength of the economy. This is correlation, not causation. As a general rule, the budget balance is a very poor guide to interest rates, both over time and across countries. The industrialised country with the lowest interest rates in recent years has been Japan, which has also seen the worst fiscal deficits.

Readers are invited to submit entries for the silliest or most overwrought comment and analysis on the budget, either in comments or via email. A small prize may ensue for the best entry.

posted on 09 May 2006 by skirchner in Economics

(2) Comments | Permalink

The RBA’s quarterly Statement on Monetary Policy is something of a misnomer, because most of the document studiously avoids any discussion of monetary policy as such. Monetary policy gets at best a few lines describing recent policy actions (or lack of action). Another few lines contain a broadbrush inflation forecast, which is the bottom-line for policy and from which policy inferences can be made.

Even though the inflation forecast is made on a no policy change basis, there is a sense in which the inflation forecast is endogenous. It is unlikely the Bank would ever forecast inflation outside the target range in the SOMP, because by the time such a forecast made it into the quarterly Statement, the RBA would almost certainly have acted on that forecast with a change in interest rates. The May Statement was a case in point, with the inflation forecast left unchanged, largely because the RBA had already tightened earlier in the week.

It is surprising then that so many in the markets look to the Statement for an explicit policy bias, since more often than not, it has none. The May Statement contained a little exercise historical revisionism, in which the RBA sought to retrofit a bias that was far from apparent in recent SOMP’s. According to the May SOMP:

the Board had taken the view that the next move in interest rates was more likely to be up than down, and this was signalled in the Bank’s policy statements.

In a narrow sense, this is untrue. Both the November and February SOMP’s said that ‘the Board recognises that policy would need to respond in the event that demand or inflation pressures prove stronger than currently expected.’ This falls well short of an explicit tightening bias and is little more than a statement of the obvious.

It was left to Governor Macfarlane to make it explicit, firstly in off the cuff remarks in response to a question at an ABE dinner in December last year and again in testimony before the House Economics Committee in February. As we noted at the time, Labor MHR Dr Craig Emerson was astute enough to pick the discrepancy between the February Statement and Macfarlane’s testimony. So what started as little more than an obvious statement of risks in the November SOMP turned into a May tightening, without ever making its way into a SOMP as an explicit tightening bias.

The May tightening statement also noted that underlying inflation in Q1 was running at 2.75%. The only “underlying” measures of inflation running at around this rate in Q1 were the RBA’s statistical weighted median and trimmed mean series. The statistical series are sometimes referred to as the “RBA core” series, but only in the sense that the RBA constructs and publishes them. These measures seek to identify the central tendency of inflation, but are necessarily somewhat arbitrary in what they exclude. The exclusions-based analytical series calculated by the ABS have a stronger economic motivation, in that they exclude items which are known to be volatile or that are non-market determined.

The reason the median market economist gave only a 40% probability to a rate rise in May was that they were looking at the ABS exclusions-based core series, which was running at only 1.7% y/y in Q1. The RBA has given “underlying” inflation an Alice in Wonderland quality, in which underlying inflation means whatever the RBA chooses it to mean.

posted on 06 May 2006 by skirchner in Economics

(0) Comments | Permalink

Page 86 of 111 pages ‹ First < 84 85 86 87 88 > Last ›

|