Capital City House Price Inflation: Sydney versus the Rest

The ABS has released its March quarter house price indices, which continue to show divergence between house prices in Sydney and the other capitals. As we have noted previously, the heterogeneity in capital city house price inflation argues strongly against attempts to explain house prices with respect to national factors, such as fiscal and monetary policy. It also suggests that it is the economy that drives house prices, rather than the other way around. House price inflation is strongest in those states benefiting most from the commodity price boom, a development exogenous to the Australian economy.

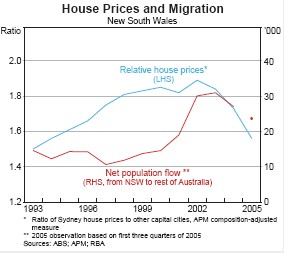

The RBA’s most recent Statement on Monetary Policy noted the role of divergences in regional economic performance and inter-state internal migration as a driver of relative house price movements.

posted on 25 May 2006 by skirchner

in Economics

(5) Comments | Permalink | Main

|

Comments

Blind Freddie can see that the resources boom is driving house prices in Perth, but what, pray tell, was driving the housing market in Sydney between 2001-2003? The only answer I can come up with is the housing market itself, and people’s fear that if they didn’t buy now they’d never be able to afford a house in Sydney. Ultra low interest rates (and easy credit) might have been the spark that got the boom going but the market clearly got ahead of fundamentals towards the end of the boom and is now coming back to earth. A classic (dare I say it) *bubble* scenario.

I’ve asked this question a dozen times here and never got a satisfactory answer. I don’t want read more waffle like “it was a combination of factors” OR “its difficult to determine” yada yada yada. Everyone else in country thinks it was a bubble, but you think the Sydney housing boom was driven forces by the real economy. To have any credibility on this issue you have to name those forces.

Posted by .(JavaScript must be enabled to view this email address) on 05/26 at 10:03 AM

There was a global price shock to housing as an asset class in 2001-2003 in the wake of the downturn in equity markets and there was a stronger degree of co-movement between capital city house prices at that time. Commodity prices hit bottom at the end of 2002 (actually an even bigger slump than in 1999 on some measures), so is not surprising that Sydney would outperform the resource rich states in that context. What we are seeing now is just a reversal of those former trends.

Posted by skirchner on 05/26 at 11:55 AM

So your argument is, that in the wake of the “tech wreck” and 9/11 the money that was invested in equities had to go somewhere, so it went into housing? If that were the case I would expect some correlation between the size (and timing) of the correction in equity markets, and the boom in real estate markets. In fact, the correction in the ASX was fairly modest (and happened later) compared with overseas markets, but the Australian housing boom was bigger and earlier.

A slump in commodity prices certainly explains a sluggish housing market in WA during 2001-2002, but I don’t see how it explains an unprecedented housing boom in Sydney, Melbourne and Brisbane.

I bought a house in Sydney during that period and attended many auctions and inspections. I can’t remember overhearing people saying “I’m doing so well now I can afford more”, but I do remember plenty saying “We can do this up in 6 months and make a $100,000 profit” and “We have to buy now or we won’t be able to afford anything in 12 months” and “We have to move quickly because there are a five other buyers who will pay more”.

It was a BUBBLE! To pretend that it was driven solely by economic fundamentals just isn’t credible.

Posted by .(JavaScript must be enabled to view this email address) on 05/26 at 04:49 PM

I don’t think anyone buys an asset with an expectation of making a loss, so appealing to expectations doesn’t get us very far!

Posted by skirchner on 05/26 at 05:29 PM

Up until the recent boom I don’t think anyone bought a house expecting to sell it 6 months later!

Still no answers…

Posted by .(JavaScript must be enabled to view this email address) on 05/26 at 06:04 PM