Why Was Fed Policy ‘Too Easy’ Between 2002 and 2005?

Larry White has a new Cato Briefing Paper How Did We Get into This Financial Mess? White echoes a now widespread criticism of US monetary policy, that is was too easy in the first half of this decade:

The federal funds rate began 2001 at 6.25 percent and ended the year at 1.75 percent. It was reduced further in 2002 and 2003, inmid-2003 reaching a record low of 1 percent, where it stayed for a year. The real Fed funds rate was negative - meaning that nominal rates were lower than the contemporary rate of inflation - for two and a half years.

White also notes that the Fed funds rate was below that implied by the Taylor rule, a point that Taylor himself has also made.

That US monetary policy was easy at this time was no accident. It was a very deliberate policy choice on the part of the FOMC. Why was policy kept so easy for so long? One reason was the perceived threat of deflation, as Vince Reinhart recalls:

According to FOMC meeting transcripts from that year, then Chairman Alan Greenspan in November [2002] called deflation “a pretty scary prospect, and one that we certainly want to avoid.”

Then Gov. Ben Bernanke, now Fed chairman, said in September 2002, “the strategy of preemptive strikes should apply with at least as great a force to incipient deflation as it does to incipient inflation.”

In hindsight while there was clearly a strong disinflation trend back then, outright deflation didn’t appear to be as big a risk as the Fed thought. Annual growth in consumer prices never fell below 1% and was rarely below 2% after 2002.

The problem back then, Reinhart said, was “we didn’t know why inflation was going down as much as it was.”

That year, 2002, “was very much a story of uncertainty about the inflation process with some modest identifiable forces putting downward pressure” on prices, he said.

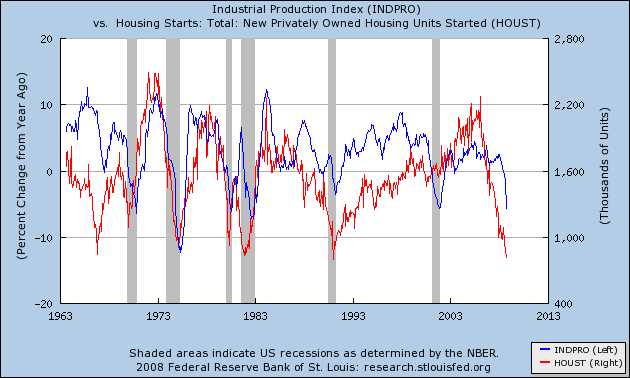

This puts the failure of US monetary policy to respond to the emerging US housing boom in its proper context. The following chart shows annual growth in US industrial production as a proxy for the broader economy, along with new privately-owned dwelling starts as a proxy for housing activity. Shaded bars are NBER-defined recessions.

The 2001 recession was exceptional compared to previous business cycles, in that housing activity did not see a significant downturn along the rest of the US economy. Industrial production was subdued coming out of the 2001 recession (note the double dip into negative growth), while housing continued to enjoy a strong expansion. If the 2001 recession could not tame the US housing boom, then it is hard to see how tighter US monetary policy could have done so without inflicting significant, and potentially deflationary, collateral damage on the rest of the economy.

One could argue that Fed policy was a success on its own terms, because it achieved exactly what it set out to do: pre-empt the threat of deflation.

posted on 21 November 2008 by skirchner

in Economics, Financial Markets

(35) Comments | Permalink | Main

|

Comments

The Fed failed to prevent the housing bubble, failed to prevent possibly the worse recession in decades, and failed to prevent deflation (based on latest US CPI). I can’t imagine how the Fed could have done a worse job.

While its probably true that if rates had been kept higher in 2003-06, economic growth would have been weaker, it surely could not possibly have been as bad as it is now.

Isn’t it time the Fed was abolished?

Posted by .(JavaScript must be enabled to view this email address) on 11/21 at 06:58 PM

Why is deflation a bad thing, or at least, why is it worse than inflation? Jorg Hulsmann has defended deflation here.

I don’t see how you reach the conclusion that the Fed policy was “successful”, unless you ignore the arguments in favour of deflation. Even Anna Schwartz and the Cato Institute have been denouncing the Fed in no uncertain terms.

The problem is that the 2001 recession should have been more severe than it was. Instead, the malinvestments were not allowed to be corrected. The government propped up bad investments. Resources weren’t directed to their most productive uses.

For those who know their history, the present situation is eerily similar to the events leading up to the worst of the Great Depression. Policymakers are doing the exact same (wrong) things. George Bush is Herbert Hoover. And Barack Obama is Roosevelt.

God help us all.

Posted by Sukrit Sabhlok on 11/21 at 07:21 PM

Deflation is fine if it is driven by long-run productivity gains, but not if it is driven by collapsing demand. The MV stabilisation theorem implies that free banking would endogenously stabilise nominal GDP, which is what central banks try to do.

Posted by skirchner on 11/21 at 07:56 PM

A protest rally against the Fed is being organised for tomorrow (21 November) in Houston.

http://www.houstonavenue.com

PS. I get the following line appearing eight times at the top of your page.

Notice: Undefined index: UP85 in /home/pmh3086/public_html/system/core/core.localize.php on line 166

Posted by .(JavaScript must be enabled to view this email address) on 11/21 at 07:58 PM

What browser are you using ED? I’m not seeing it in IE or Firefox.

Posted by skirchner on 11/21 at 08:06 PM

IE 6.0

Posted by .(JavaScript must be enabled to view this email address) on 11/21 at 10:02 PM

Well, I’m disappointed I had to wait until the second paragraph for the Community Reinvestment Act to get a metion.

Here is a much, much more interesting yarn about how we got into this financial mess:

The End of Wall Streets Boom

Posted by .(JavaScript must be enabled to view this email address) on 11/21 at 10:04 PM

I would like a clearer answer to Sukrit’s question, i.e. what exactly is the problem with deflation? How is it worse than inflation, and how does it impact on the economy, the losers and the winners?

Posted by .(JavaScript must be enabled to view this email address) on 11/21 at 10:22 PM

Deflation increases the purchasing power of money and the winners are people with cash and other liquid assets. People with illiquid assets and debts are losers. So everyone with a home loan, for example, is a loser as the real value of their debt increases.

As Stephen said above increases in productivity drive prices down - that is a good thing. Whereas collapsing demand can also drive prices down that is a bad thing. Right now if, and that is a very big if, deflation were to occur it would be due to the latter not the former.

Wikipedia has a nice summary piece

http://en.wikipedia.org/wiki/Deflation

Posted by .(JavaScript must be enabled to view this email address) on 11/22 at 08:08 AM

David Bassanese has a nice piece on deflation in the Weekend Fin Review (pg. 23).

Posted by .(JavaScript must be enabled to view this email address) on 11/22 at 09:07 AM

George Selgin argues for a productivity norm for the price level, which implies mild deflation, assuming of course that productivity growth is actually positive!

Productivity is hard to measure reliably and may vary considerably across the economy compared to consumer prices. A price stability norm is much more transparent and easier to operationalise.

Posted by skirchner on 11/22 at 03:58 PM

A question I’ve asked at several blogs:

If deflation becomes an intractable problem, why can’t “Helicopter Ben” just drop money on a grateful public?

Jeeeez-us, Quiggin has turned to the dark side.

In today’s post he says:

1. Its increasingly likely Citi will fail, and that its too big to rescue (by anyone)

2. He links to a story at CNBC that says “all US financial institutions will be nationalized within a year” which Quiggin says is probably an overstatement. Just probably (?!)

3. Switzerland will fail (like Iceland) and will have to join the Eurozone

4. The UK will be forced into the Eurozone before long

Quiggin seemed reasonably optimistic until now. I’ll know we’re in a depression when one S. Kirchner flips to the dark side.

Posted by .(JavaScript must be enabled to view this email address) on 11/22 at 04:28 PM

David, the Fed is already engaging in quantitative easing and can ramp it up further if needed.

Countries are more likely to be forced out of the eurozone than forced in:

http://www.intrade.com/jsp/intrade/common/c_cd.jsp?conDetailID=589672&z=1227333230130

Posted by skirchner on 11/22 at 05:24 PM

Less than zero is on my bookshelf to be read at some stage.

Posted by .(JavaScript must be enabled to view this email address) on 11/22 at 06:20 PM

David, the Fed is already engaging in quantitative easing and can ramp it up further if needed.

But will it work? The debt deflation doomers over at Steve Keen’s blog (yeah, that guy that keeps getting things right) say it won’t work. They don’t really say why, just that its never worked in the past (e.g. Japan in the 90s) so it won’t work now.

Does anyone have a strong opinion one way or the other whether quantitative easing can get us out of a deflationary spiral?

Countries are more likely to be forced out of the eurozone than forced in

Are these the same Intrade odds that said there was no recession in April? You know, the recession that the Philadelphia Fed now says started in April.

Posted by .(JavaScript must be enabled to view this email address) on 11/22 at 08:58 PM

In this paper, I offer an explanation for why QE didn’t work as well as it could have in Japan:

http://www.institutional-economics.com/images/uploads/catojesa2005.pdf

The opposing debt-deflationist view is summarised here:

http://www.elliottwave.com/a.asp?url=http://www.elliottwave.com/club/Inflation_vs._Deflation.aspx&cn=4ie

Posted by skirchner on 11/23 at 12:00 PM

FWIW a response from Steve Keen on why pump-priming and quantitative easing won’t work:

The government’s stimulus at present is worth about $10 billion. The reduction in spending that a stabilisation of debt at current levels (1.7 trillion) would imply over the preceding calendar year is $260 billion (since the increase in debt in the 2007-08 period was $259 billion).

That is why Keynesian “pump Priming” will fail this time round, and the only thing that will work is either inflation or debt moratoria.

The complications about inflation are that we produce so little of what we consume now, compared to the 1930s–and the same applies in America. Domestically engineered inflation will not necessarily have a balanced impact on both costs and incomes.

Also, neoclassical economists don’t have a clue about how to cause it. Their preferred “printing money” route will fail, as it did in Japan, because those in debt will use it to pay down debt rather than spend. So prices will continue to fall, and the fall in prices in part counteracts the impact of debt being reduced in monetary terms.

The best way to cause inflation is to increase wages, since this will force both firms to put up prices and workers to spend. But economists will resist that route like the plague, given their defective analysis economic of the workings of the economy.

Having said that, I reckon that an inflationary surge in the 20% or so range would do the trick–causing inflation at the level of about 20% initially and then riding it down over say a decade.

Stephen, can we have one sentence answer in plain English how and why QE *can* work if implemented correctly? Your paper had my eyes glazing over.

BTW, Krugman now says this is an economic emergency. Can you optimists give me some reasons why its not? Krugman (unlike Steve Keen) is taken seriously by most economists I imagine.

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 05:06 PM

I can’t speak for Stephen, but what you have quoted from Steve Keen is simply incoherant. Similarly Krugman was a fine academic economist, but he stopped doing that in the late 1990s (and won the Nobel for that stuff), since then he has been a columnist and his opinions on that score are just as good or bad as any other columnist. Yet it seems to me that all this talk of this being the worst since the depression is just nonsense. Unemployment remains low, there are no long queues outside soup kitchens and the like. A whole bunch of inefficient firms and business models are being cleared away - that’s what supposed to happen in a downturn. Yep it’s tough and nasty.

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 05:27 PM

DavidM: “Stephen, can we have one sentence answer in plain English how and why QE *can* work if implemented correctly? Your paper had my eyes glazing over.”

Compared to the literature on this question, my paper is the one sentence answer! If there were simple one sentence answers to questions like this, there would be no need for economists. Study any economic question in any depth, you will find competing theories and evidence that need to be weighed. You should not be satisfied with one sentence answers coming from me or anyone else.

Posted by skirchner on 11/23 at 06:04 PM

Yet it seems to me that all this talk of this being the worst since the depression is just nonsense.

Ok, here a few indicators that are in territory that we haven’t seen since the depression (and I’m mainly talking about the US and UK here, not Australia):

1. Debt to GDP ratios are at unprecedented levels, while asset prices have collapsed.

2. Personal savings rates have been in decline since the mid-1980s and were negative at the top of the boom for the first time since the depression.

3. Banking failures (Lehman, Bear…), part nationalisations (RBS, HBOS-Lloyds TSB, Citi?), full nationalisations (Northern Rock, Bradford & Bingley) and bank runs (Northern Rock, B&B, Bear, IndyMac, WaMu…). We haven’t seen bank runs in western nations since the 30s have we? Ok, maybe a few during the S&L crisis but nothing on the scale of this!

4. Nationalisation of Fannie (founded in the depression) and Freddie.

5. The end of the Wall St model of investment banking, and the failure of institutions such as Bear and Lehman that survived the depression.

6. The worst stock market declne since the depression.

7. The steepest drop in US house prices since the depression.

8. Credit markets have been frozen for more than two months now in a way that hasn’t been seen since the depression.

Surely this adds up to a historically significant event. Ok, unemployment is still relatively low, but its only been heading one way recently, and unemployment is a lagging indicator. All the leading indicators are absolutely shocking.

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 08:53 PM

“Ok, unemployment is still relatively low, but its only been heading one way recently”

damn Rudd government… :)

Nobody denying that economic conditions have been turbulent, but I am denying this is equivalent to the great depression.

Now you’ll remember a long email debate we had several months ago when you told me that peak-oil had arrived and the oil-price was going to be ten billion zillionty dollars per barrell, or something (okay maybe not that much) and I said the price was too high and would come down again. Well now I’m saying the economy will recover - a whole bunch of people who made bad decisions will be out of business and their places taken by a whole bunch of others, who in turn will make bad decisions and so on.

Looking at the indicators that you mention some fall into the ‘yes/no/maybe’ category, others into the ‘so what?’ category, the ‘who cares?’ category and the ‘good’ category. The stock market has fallen about as much as the 1987 crash (slightly more depending on how you measure it), some long-term institutons have failed (whatever), Fannie and Freddie should have closed down yonks ago, and so on.

Sure Mr Rudd has been telling people we’re facing a depression, but he’s just blown the budget surplus in a panic and guaranteed all deposits in a panic too. What else is he going to say (apart from taking credit for avoiding a depression). I’m going to take my cue from Reagan and hope for a ‘recovery’ in 2010 :)

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 09:30 PM

I’m not really interested in scoring political points on the Rudd govt. Every point I made above related to the US (and lesser extent UK). I didn’t mention Australia, and what Australia does is pretty irrelevant on a global scale.

I’m really interested in which are your ‘so what?’ indicators and why? Is private-debt-to-GDP ratio a problem, especially now that asset prices have collapsed? Is the personal savings rate an issue? Is the intractable (and worsening) US budget deficit an issue? Is the Chinese current account surplus and currency manipulation an issue?

Which, if any, of these are serious problems?

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 09:56 PM

I mentioned Australia - that’s where we live and that’s where the government has been claiming we face the greatest crisis since the great depression.

“1. Debt to GDP ratios are at unprecedented levels, while asset prices have collapsed.”

I putting this into the even if true, I’m not sure what the long-term significance of this is. Debt is not inherantly bad, indeed corporate debt is good, government debt is bad and personal debt varies with the ability to pay it back. Debt has freed millions of people from temporal constraints allowing them to live better lives. I am not a member of the anti-debt brigade (except government debt).

“2. Personal savings rates have been in decline since the mid-1980s and were negative at the top of the boom for the first time since the depression.”

This is a US figure - not sure what the significance is to Australia. Savings here are apparently low too, but must be captured in housing prices and superannuation.

“3. Banking failures (Lehman, Bear…), part nationalisations (RBS, HBOS-Lloyds TSB, Citi?), full nationalisations (Northern Rock, Bradford & Bingley) and bank runs (Northern Rock, B&B, Bear, IndyMac, WaMu…). We haven’t seen bank runs in western nations since the 30s have we? Ok, maybe a few during the S&L crisis but nothing on the scale of this!”

We saw bank runs in the late 1980s in Victoria (maybe singular bank run). Bank failures are not rare in the US. Go to the FDIC website and see the list - sure they are usually small banks, but its hard to get excited about this. We have seen big banks fail - to the best of knowedge some of these guys don’t even have depositors so I can’t see too much justification for the bail outs.

“4. Nationalisation of Fannie (founded in the depression) and Freddie.

Should have been shut down years ago.

“5. The end of the Wall St model of investment banking, and the failure of institutions such as Bear and Lehman that survived the depression.”

So what?

“6. The worst stock market declne since the depression.”

Even if true, so what?

“7. The steepest drop in US house prices since the depression.”

This is due to government failure.

“8. Credit markets have been frozen for more than two months now in a way that hasn’t been seen since the depression.”

So I keep hearing.

I am no great fan of the RBA governor but he gave a very good speech on Wednesday - I disagree with the notion that government shoudn’t worry about going into deficit - but most of his speech was pretty sensible. The long term fundamentals in Australia are sound, our banking system is sound and well capitalised, our economy will recover as will the US and the EU and so on.

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 10:19 PM

RE: 1. Obviously not all debt is bad, but if I’m not mistaken, a large proportion of US (and Australian) personal debt was used for consumption, and to purchase existing housing stock.

RE: 2. Personal savings rates in the U.S. are low *and* housing prices have collapsed *and* retirement savings have collapsed. 2 out of 3 of those are true of Australia as well.

RE: 3. WaMu was the largest savings and loan institution in the US, and held deposits of $188.3 billion on June 30 2008. Citibank, if it fails, was the largest bank in the world as recently as last year. There were lots of bank failures during the S&L crisis in the 1980s but these were much smaller institutions.

RE: 8. Do you disagree with this? Are the credit markets unimportant? Do you think the current crisis will pass quickly if left to its own devices?

Posted by .(JavaScript must be enabled to view this email address) on 11/23 at 11:18 PM

“personal debt was used for consumption” - that is what personal debt has always been used for. Debt for personal consumption is nothing new. The real innovation in debt finance has been the democratisation of debt - debt used to be a privilege for the elite and everyone else paid cash. The anti-debt brigade would ahve a lot less support if they explained to everyone that they would have to pay their utility bills in advance and could only purchase items with physical cash (or cheques).

“2 out of 3 of those are true of Australia as well” This may be true, but what is the significance? (Have housing price ‘collapsed’? - certainly come off at the high end, but the average housing price hasn’t ‘collapsed’). Retirement savings have collapsed because the stock market has collapsed, the market will recover, so too retirement savings. In the meantime, the market signal is that everybody should work more.

“these were much smaller institutions.” Size should be no impediment to failure - indeed, over time banks and firms get larger and so over time failures will occur in larger firms than before.

“Do you think the current crisis will pass quickly if left to its own devices?”

Yes. We have a financial system built around trust and lenders of last resort - let that system work to resolve the credit market problem.

At the moment we have three things happening. (1) the system is working to resolve the crisis (2) the government is trying to prop up inefficient firms (3) the government is trying to stave off recession. At least (2) is prolonging (1) and (3) is not a good idea either.

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 07:19 AM

RE 1: If personal debt for consumption is fine, what is your opinion on the debt used to inflate the price of existing housing stock?

RE 2: In Australia, its housing that’s the odd one out. All three (savings, housing, retirement) have collapsed in the US. I can see housing coming off further here but not to the extent that it has in the US because we seem to be chronically under supplied, and borrowers can’t simply mail back the keys if they get in trouble.

RE 3: “Size should be no impediment to failure” The point is that if you add up the assets and deposits of all the failed banks (in today’s dollars) 2008 is the biggest on record.

RE 8: “the crisis will resolve itself”: So you would like to see a short, sharp correction with a (hopefully) equally sharp recovery, rather than a long downturn prolonged by government interference?

My greatest fear is the ‘great deleveraging’ will continue for many years because the debt burden is so huge. Individuals and companies will use every last cent to pay down debt, driving the global economy further into recession.

Is this an uwarranted fear, and if so, why?

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 09:11 AM

RE1: Don’t understand what you mean here.

RE3: and?

RE8: Yes.

The global economy may well go into recession, but its not clear that people will spend every last cent paying debt. For what purpose? It is not as though the world economy hasn’t gone into recession before and recovered.

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 11:07 AM

RE 1: I would imagine that the ‘best’ kind of debt is that borrowed by a business or entrepreneur to create a new income stream. Yes? However, debt used to buy an existing house really doesn’t add anything to the economy. No income stream is created, no new housing is created, just more debt.

RE 3: Well, the rest of the world seems a tad concerned about the scale of the banking failures in recent months. Why are you not concerned?

RE 8: “It is not as though the world economy hasn’t gone into recession before and recovered”. Of course, but the world economy has never gone into recession with this level of indebtedness before. The only comparable period was the depression. It seems to me that more income will funnelled into debt this time around because there’s so much more debt.

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 11:34 AM

No. Corporate debt that creates an income stream is appropriate, but also the Jensen Debt control hypothesis states that debt can have good corporate governance characteristics too. Personal debt is mostly used to smooth earnings and income over the life time of the individual. So most people do not get an income stream from their house - although they do get housing benefits.

Firms with poor business models are supposed to fail in a crisis - everyone carries on about creative destruction, well now you’re seeing it happen.

You keep saying that the only comparable time is the great depression, but I see no evidence of that. Recessions happen - but I should point out that we are not even at that stage.

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 11:48 AM

Recessions happen - but I should point out that we are not even at that stage.

Again, I’m talking about the US and UK mainly, both of which are in recession. Australia is not in recession (yet) but given our recent dependence on mining income, and the collapse in demand for our commodities and commodity prices, it seems quite likely we’ll negative growth in Q1 2009, and possibly Q4 2008. Mainstream economists have been back pedalling their forecasts all year.

You keep saying that the only comparable time is the great depression, but I see no evidence of that

Ok, one last time…

Debt vs GDP appears to peak at the onset of a depression:

Australia’s Debt to GDP Ratio from 1860-Now

USA’s Long Term Debt to GDP Ratio 1920-Now

The Debt vs GDP ratio is now at historic highs, we’ve had a major financial crisis and a severe credit crunch. These appear to have been the precursors of a depression in the past, and we haven’t seen all three since the 1930s.

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 12:18 PM

From memory Mining value added to GDP is about 5%. We might go into recession and I agree many economists have been backpedling. All those guys saying that the tax cuts should be cancelled are now say the budget should go into deficit. (Nyuk, Nyuk, Nyuk.) But as even the RBA governor recognises there is something called the business cycle and economies go into recession from time to time.

You still haven’t told me why that stat is important. I can think of a reverse causality story - when incomes decline people borrow less - that is exactly opposite what you keep telling me.

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 12:39 PM

You still haven’t told me why that stat is important.

Sure, I’m saying that the correlation between peaks in the debt-to-GDP ratio and depressions is striking, but correlation is not causation.

The trigger for debt-deflation is a crisis of confidence, in this case coming from the sub-prime fiasco, CDOs, CDSs etc. What follows, according to Steve Keen, is something like this…

Posted by .(JavaScript must be enabled to view this email address) on 11/24 at 12:56 PM

Debt to GDP ratios are in a secular uptrend in all countries at all times because financial intermediation increases with economic development, so this tell us nothing.

The stylised facts of the business cycle are well known. What’s not well understood are the underlying causal mechanisms because statistical tests are only weakly suggestive of causality and we lack appropriate natural experiments.

The narrative identification strategy of Friedman and Schwartz is about as good as its gets in macro, unless you are an axiomatic Austrian, in which case, you’ll never let the facts get in the way of a good story.

Posted by skirchner on 11/24 at 02:13 PM

Stephen I posted your comment that debt-to-GDP ratios “tell us nothing” at Steve Keen’s blog, but no response as yet.

I couple of tidbits I read this morning about Sinc’s “crisis that isn’t”:

- Bloomberg reports U.S. Pledges Top $7.7 Trillion to Ease Frozen Credit

The money that’s been pledged is equivalent to $24,000 for every man, woman and child in the country. It’s nine times what the U.S. has spent so far on wars in Iraq and Afghanistan, according to Congressional Budget Office figures. It could pay off more than half the country’s mortgages.

- Calculated Risk reports NAR:// Re-Default Rate 50% of Modifications

“The Realtors are reporting that foreclosure sales - that is distress sales being foreclosures or short sales - have risen from what they thought was 35% to 40% of all existing home sales, now they are saying it is 45% of all existing home sales. They also are saying they are seeing further softening toward the November numbers.

And they are hearing from the Realtors they talk to that the re-default rate on a lot of these loan modifications are running at 50% - that is half those of modifications aren’t working.”

Nothing to worry about here, move along, move along…

Posted by .(JavaScript must be enabled to view this email address) on 11/25 at 10:49 AM

Sinclair Davidson wrote:

“Do you think the current crisis will pass quickly if left to its own devices?“

Yes. We have a financial system built around trust and lenders of last resort - let that system work to resolve the credit market problem.

I’ve read a lot of commentary lately that suggests the big mistake in the management of this crisis (the “game changer” its been called) was allowing Lehman to fail. You seem to be advocating that the authorities should not interfere and allow all troubled institutions to fail. Do you belive the GFC would be better/worse shorter/longer if Citigroup, AIG etc had been allowed to fail?

Posted by .(JavaScript must be enabled to view this email address) on 12/01 at 10:18 AM