Debunking the Myth of Low Household Saving

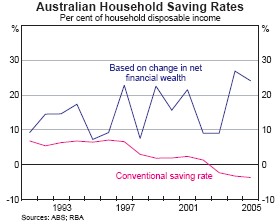

One of the more pernicious myths about the Australian and US economies is that their household sectors do not save and have lower saving rates than other industrialised countries. This largely reflects the much higher rates of household ownership of equities in Australia and the US than other countries, an important economic strength rather than weakness, but one that is not captured by conventional measures of household saving.

The RBA’s May Statement on Monetary Policy calculates a broader measure of household saving based on net financial wealth. As the RBA notes, this measure ‘presents a more realistic picture of Australian household saving behaviour than conventional measures.’ It shows a steady trend in household saving.

posted on 05 May 2006 by skirchner

in Economics

(6) Comments | Permalink | Main

|

Comments

Interesting. Reminds me of your recent post on the RBA bulletin regarding Australian investment abroad and the current account. Apparently, some commenters need to include equity in there macro-analysis!

I’ve seen others include home equity gains as savings (Malpass, I think). I haven’t been convinced that it is savings, but it’s obviously an increase in overall worth. Some complain about MEW’s, but I would wager it’s small relative to the overall level of increases. Can you guys borrow against your home for consumption/investment?

Posted by cb on 05/06 at 03:08 AM

“Can you guys borrow against your home for consumption/investment?” Yes.

Conventional measures of household saving subtract depreciation of the housing stock, a subtraction that gets larger as the capitalisation of the housing stock grows. As the RBA notes, gross household saving is positive, even on conventional measures.

Posted by skirchner on 05/06 at 01:50 PM

Wouldn’t this mean that in a speculative real estate market it would show a healthy “net financial wealth” even though the household was spending more than it was making?

Posted by Andrew on 05/10 at 09:16 AM

Andrew, yes, that’s the whole point. The traditional income-based measures do not provide a very good account of actual household saving behaviour.

Posted by skirchner on 05/10 at 10:06 AM

Sorry I’m confused; its the traditional income-based meaures or the new approach that would show a healthy savings in a speculative real estate market?

Posted by Andrew on 05/10 at 10:29 AM

I would argue that the net wealth-based approach provides a better characterisation of saving behaviour at all times, not just in “speculative” markets.

Posted by skirchner on 05/10 at 10:50 AM