Contrarian Optimism and the National Accounts

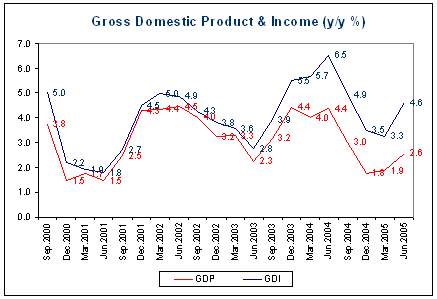

Proving once again that there is no market for good news, yesterday’s Q2 national accounts release attracted relatively little attention compared to the hysteria that accompanied the Q4 release. The most remarkable feature of the Q2 release was the large wedge that the stunning double-digit growth in Australia’s terms of trade has driven between the gross domestic product and income accounts (shown below in y/y terms).

Gross domestic income rose 2.4% q/q compared to the 1.3% q/q rise in GDP. GDI better captures the welfare gains arising from the increased purchasing power of domestic production that flows from an improved terms of trade. It also puts the current account deficit in perspective, by showing the enormous welfare gains from substituting low cost imports for domestic production.

Needless to say, the economic Armageddon that was supposed to be unleashed by falling house prices is nowhere in sight. No doubt weakness in house prices has further to run and will have a small negative wealth effect. But the dwelling investment cycle appears to have turned already, with both dwelling investment and ownership transfer costs making positive growth contributions in Q2.

posted on 08 September 2005 by skirchner

in Economics

(4) Comments | Permalink | Main

|

Comments

Agreed it is good news, but virtually all of it is due to a spectacular spike in commodity prices that can turn around just as quickly.

RBA Index of Commodity Prices:

http://www.rba.gov.au/Statistics/commodity_prices.html

Meanwhile non-commodity exporters (like me), and import replacement manufacturers, struggle to survive because of the high $AUD.

Posted by .(JavaScript must be enabled to view this email address) on 09/09 at 09:39 AM

Commodity prices are not going to be heading south in a hurry. People can’t live on the bells and whistles tacked onto the latest piece of software. They have to grow food, fabricate things and move stuff around.

There has been global underinvestment over much of the past generation in primary industrial plant, equipment and resources. And now, with the massive populations of IND and PRC wanting a piece of the action, the demand for material goods looks set to stay high.

So the financial windfalls associated with the current AUS economic boom are likely to keep falling into our laps. Howard, like Napoleans best generals, has been quite lucky.

Posted by Jack Strocchi on 09/09 at 07:24 PM

Ahhh how quickly conventional wisdom turns around. Was it just five short years ago that Australia was seen as “old economy” at the dawn of the “new economy” century? We were dismissed as little more than a quarry and a farm, unlikely to ever produce a Nokia, Google or Samsung.

Commodity prices have always been volatile and ultra-sensitive to shifts in the global economic winds. Look at the chart, when the correction comes it will be quick and nasty.

Posted by .(JavaScript must be enabled to view this email address) on 09/09 at 10:02 PM

Consider me justly ridiculed. I was certainly, at least until the Asia Crisis, swept up with the general hysteria about info-tech, globalization and the New Economy. Although even I could see (c. 1999) that the dot.com bubble was bs.

I still think that the New Economy - the virtualiation of economic activity - will continue to revolutionise industry. But it will be in conjunction, not displacement, of the Old Economy. Wal Mart is the model for this mode of economic development.

In fairness to myself, in 2002 I did privately predict that the world was nearing the inflection point of the Hubbert Curve. I assumed that Gulf War II was waged to bring Iraq oil back on line to counter-act the windfall that would accrue to OPEC’s Baathists. How dumb was that!

Abrupt shocks like the oil price spike, the swelling Asian demand for our minerals and the real estate boom forcefully bring home the fact that human beings still rely an awful lot on the Old Economy of actual material things.

Posted by Jack Strocchi on 09/10 at 07:51 AM