Doomsday in the Fever Swamp

Just in time for April Fool’s Day, Time magazine profiles The Armageddon Gang. As the article notes, their ‘stark, almost Puritan way of looking at the world… has been out of step with economic reality for the past quarter-century.’

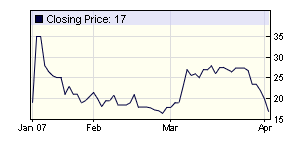

Meanwhile, Intrade’s US 2007 recession contract is in the grip of a bear market of its own:

posted on 02 April 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

In Defence of Sub-Prime Lending

Chicago’s Austan Goolsbee defends innovations in mortgage markets against economic and financial Luddites like Nouriel Roubini:

Almost every new form of mortgage lending — from adjustable-rate mortgages to home equity lines of credit to no-money-down mortgages — has tended to expand the pool of people who qualify but has also been greeted by a large number of people saying that it harms consumers and will fool people into thinking they can afford homes that they cannot…

These innovations mainly served to give people power to make their own decisions about housing, and they ended up being quite sensible with their newfound access to capital…

The traditional causes of foreclosure, even before there was subprime lending, were job loss, divorce and major medical expenses. And the national foreclosure data seem to suggest that these issues remain paramount. The latest numbers show that foreclosures have been concentrated not in places where real estate bubbles have supposedly been popping, but rather in places whose economies have stagnated — the hurricane-torn communities on the Gulf of Mexico and the industrial Midwest states like Ohio, Michigan and Indiana, where the domestic auto industry has suffered. These do not automatically point to subprime lending as the leading cause of foreclosure problems.

Goolsbee must be a member of the ‘cabal of supply side voodoo ideologues.’

posted on 30 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Costello Stole First

Treasurer Peter Costello has a particularly silly op-ed in The Australian, accusing opposition leader Kevin Rudd of being a ‘burglar’ and ‘raiding the savings of future generations’ with his proposal to dip into the Future Fund to pay for the Labor Party’s broadband initiatives. This conveniently ignores the fact that Peter Costello is a step ahead of Rudd, having already raided the savings of current generations to endow his Future Fund. It make no difference whether Rudd funds his broadband initiatives from the Future Fund or some other source, just as it makes no difference whether public service superannuation liabilities are funded out of current or future revenue. A dollar is a dollar.

There is plenty to criticise in Rudd’s broadband proposals. The issue is whether the money should be spent on broadband at all, not whether it comes from the artificial lock-box the government has created to quarantine its budget surpluses.

My critique of the Future Fund can be found here.

posted on 29 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

‘Quiet Boom’ & ‘The Search for Stability’

Former Prime Ministerial economic adviser John Edwards’ Quiet Boom provides an account of the origins and consequences of the current unprecedented 16-year expansion of the Australian economy. Former RBA Governor Ian Macfarlane’s The Search for Stability is an overview of the post-war history of macroeconomic stabilisation policy, with particular reference to Australia. Both Edwards and Macfarlane have been intimately involved in macroeconomic policymaking. Yet on the defining event of Australia’s recent economic history - the recession of the early 1990s - they provide very different accounts. Of these two interpretations, Edwards’ is the more compelling.

continue reading

posted on 27 March 2007 by skirchner in Economics

(2) Comments | Permalink | Main

Separating Alpha and Beta

Alan Kohler points to the separation of alpha from beta in funds management, led by QIC’s Doug McTaggart (co-author of one of the better undergraduate economics texts):

At QIC, Doug McTaggart has separated alpha and beta into entirely different business streams, with separate profit and loss statements. This applies to the 50 per cent of QIC’s money that is managed internally as well the half that’s managed by outside fund managers.

McTaggart says he is pushing for performance-only fees but he’s not quite there. But he’ll get there and so will other Australian institutions. Whether smaller investors benefit from this revolution depends on the financial planners and wrap/platform operators who say they are acting in their clients’ interests.

In fact, there is no reason why Australian retail investors can’t do this for themselves, by combining index funds such as those provided by Vanguard with investments in absolute return or hedge funds, which are readily available to Australian retail investors.

posted on 24 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Zero Bubble

James Hamilton goes looking for the so-called US housing ‘bubble’ and comes up empty.

posted on 24 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

‘Healthy, fat and comfortable on their iceberg’

An Australian graduate student, her polar bear photo and the Disneyfication of politics.

posted on 22 March 2007 by skirchner in Culture & Society, Politics

(0) Comments | Permalink | Main

Hedge Fund Apparel

What every hedge fund manager is wearing this Autumn (Spring for those north of the equator).

posted on 21 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

‘Free Market Supply Side Voodoo Fundamentalism Zealots’

Nouriel Roubini finally goes over the edge:

who is at fault for this utter housing and financial disaster. The answer is clear: the blame lies with free market zealot and fanatics and voodoo economics ideologues who captured US economic policy in the last six years.

Who knew?

posted on 19 March 2007 by skirchner in Economics, Financial Markets

(4) Comments | Permalink | Main

Intrade Australian Federal Election Contract

Intrade is offering a contract on the outcome of the Australian federal election due later this year. Only one contract done so far, with Labor bid at 55. This should make an interesting complement to the local bookmakers, assuming Intrade can attract enough liquidity to the contract.

posted on 15 March 2007 by skirchner in Financial Markets, Politics

(0) Comments | Permalink | Main

Friedman vs Krugman

Last night, CIS hosted a tribute to Milton Friedman, which will eventually be forthcoming as a monograph. The task of doing justice to Friedman is a daunting one, but the guest speakers did an excellent job covering the breadth of his contribution. The depth is much harder to elucidate. A common misconception is that monetarism was discredited by the monetary targeting experiments of the 1970s and 80s. Monetary targeting as practiced by central banks was quite removed from Friedman’s proposal for a constant money growth rule. Friedman’s advocacy of a constant money growth rule was itself grounded less in the quantity theory of money, than in Friedman’s view that central banks had neither the technology nor the incentives to conduct monetary policy in a stabilising fashion. The aim of the rule was to remove discretion from the conduct of monetary policy.

Friedman’s view proved too pessimistic, but only because Friedman was ultimately more persuasive in promoting the cause of monetary stability than even he could imagine. As Fed Chair Ben Bernanke recently noted:

Friedman’s monetary framework has been so influential that, in its broad outlines at least, it has nearly become identical with modern monetary theory and practice.

Contemporary monetary policy theory and practice can be given quantity theory foundations, even though it is no longer discussed explicitly in quantity theory terms. Indeed, Leland Yeager argued years ago that most New Keynesian macroeconomics was just a re-labelling of old school monetarism.

Friedman’s monetary economics is unfortunately still the subject of much misunderstanding, exemplified by Krugman’s recent ill-informed attack on Friedman’s intellectual integrity. Ed Nelson and Anna Schwartz’s response can be found here. See also Larry White.

Krugman tries to argue, contrary to Schwartz and Nelson, that Japan’s open market operations under ‘quantitative easing’ demonstrate the possibility of a liquidity trap. As I show in this paper, Japan’s quantitative easing regime was conditioned on a neo-Wicksellian rather than monetarist view of the monetary policy transmission process, and was carefully calibrated to the demand for reserves on the part of the Japanese banking system.

posted on 13 March 2007 by skirchner in Economics

(0) Comments | Permalink | Main

Should Greenspan Blog?

Kevin Hassett makes the case for Greenspan to turn blogger:

Greenspan needs to enter the information age he has spoken so wisely about in the past. He needs to start a blog.

Think of it. He could post for all the world to see, his latest assessment of the state of the economy, including the detailed analysis of motor-vehicle scrappage and other arcana that colored his tenure as Fed chairman.

To protect himself against the appearance of impropriety, he could draw on the blog when he speaks publicly, and fully inoculate himself against harmful accusations. He could even sell advertising.

Greenspan is in a unique position to help Americans understand the economy they live in better. It would be a shame for him to retreat into the shadows after a bad week of publicity. The fact is, his opinions need more visibility, not less.

With Greenspan’s memoirs to be published in the not too distant future, a marketing blog would not be surprising. Afterall, the publisher has an $8.5 million advance to recoup. Somehow, I don’t think Greenspan will need the Google ads revenue.

The Hong Kong Monetary Authority’s Joseph Yam maintains a blog of sorts.

posted on 13 March 2007 by skirchner in

(0) Comments | Permalink | Main

Felix Salmon and the Unbearable Lightness of Nouriel

Felix Salmon resorts to the Seinfeld defence in discussing Chairman Roubini’s latest piece of doom-mongering:

it generally asserts at least as much as it argues, and is written more colloquially than formally. Not that there’s anything wrong with that.

posted on 10 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Ben Bernanke’s Diary

Dow Jones Newswires have obtained Ben Bernanke’s visitor log through an FoI request:

Topping a list that included Wall Street heavyweights like Bear Stearns Cos. and Morgan Stanley, however, was a small St. Louis-based forecasting firm: Macroeconomic Advisers….

Former Fed Gov. Laurence Meyer and former Fed economist Brian Sack, both now with Macroeconomic Advisers’ Washington office, enjoyed the greatest access to Mr. Bernanke among private-sector economists, the Fed chairman’s visitor logs show.

The pair met with Mr. Bernanke three times last year, in March, August and September. Mr. Sack met with Mr. Bernanke an additional time in July, the logs showed…

It lists only the names of people cleared through security to meet with him specifically. He may have also met with other people who were cleared to meet with other Fed officials.

Since taking the helm at the Fed in February 2006, Mr. Bernanke has sat down with several Wall Street economists, including Richard Berner of Morgan Stanley, David Malpass of Bear Stearns and several members of the American Bankers Association’s economic advisory panel.

Top academics on his visitor logs include: Martin Feldstein, head of the National Bureau for Economic Research; Princeton Prof. and former Fed Vice Chairman Alan Blinder, and C. Fred Bergsten of the Peterson Institute for International Economics.

posted on 06 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

The Demise (Yet Again) of ‘Peak Oil’

An article in the NYT documents how market incentives and technology are working against ‘peak oil’ Malthusianism:

Within the last decade, technology advances have made it possible to unlock more oil from old fields, and, at the same time, higher oil prices have made it economical for companies to go after reserves that are harder to reach. With plenty of oil still left in familiar locations, forecasts that the world’s reserves are drying out have given way to predictions that more oil can be found than ever before…

There is still a minority view, held largely by a small band of retired petroleum geologists and some members of Congress, that oil production has peaked, but the theory has been fading. Equally contentious for the oil companies is the growing voice of environmentalists, who do not think that pumping and consuming an ever-increasing amount of fossil fuel is in any way desirable.

‘Peak oil’ is one of those hardy perennials that never seems to go away. Last year, the Weekend Australian Magazine (no link) ran a profile of people who were hoarding tinned food and growing their own vegetables based on the Malthusian idea of economic collapse due to resource depletion. Rather than ridiculing these people, the article took them quite seriously.

posted on 06 March 2007 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Page 74 of 111 pages ‹ First < 72 73 74 75 76 > Last ›

|