2010 03

1. Greece and the internet’s dark pools of hate.

2. None dare call it stimulus.

3. McTeer and Hamilton on inflation and interest rates.

4. Chris Berg on immigration (the overlooked counterpart to Bob Birrell’s Policy essay).

5. David Goldman on Barack Obama.

6. Chris Joye’s Sydney house price growth guessing competition.

posted on 31 March 2010 by skirchner in Economics

(1) Comments | Permalink | Main

Matthew Richardson on the missing outrage over Freddie and Fannie:

There’s a chance that the support thrown at the rest of the financial sector—$465 billion of direct capital, $285 billion of loan guarantees and insurance of $418 billion of assets—isn’t all money down the drain. $175 billion has been returned, the loan guarantees look much safer, and the insurance program, mainly for Citigroup, has been terminated.

Even the poster child for financial excess, AIG, may be able to fully pay off the government if the housing market doesn’t deteriorate further or the economy substantially improves.

But the chances are slim to none that Fannie or Freddie will be able to pay back the funds. It is highly likely that taxpayers will lose well over $200 billion—and it may well pass $300 billion. When the history of the crisis is all written, these two institutions will turn out to be the most costly of the financial sector—worse than AIG, Citigroup or Bank of America/Merrill Lynch.

So where is the outrage?

It’s not the pay packages: Compensation at Fannie and Freddie was right up there with other financial firms. For example, in 2006 and 2007, as housing conditions were weakening and the crisis started, the CEO salaries of Fannie were $14.4 and $12.2 million, and Freddie were $15.5 million and $19.8 million.

As Eric Falkenstein has also noted, the losses attending Freddie and Fannie are equal to around 90 Nick Leesons.

posted on 30 March 2010 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

Former RBA Governor Ian Macfarlane took pride in never having given an on-the-record media interview in his 10 years in office. Macfarlane’s public appearances were about as common as those for your average thylacine. Macfarlane only drew attention to the problem by engaging in a post-retirement media blitz that sought to set the record straight on all the issues where he claimed to have been misquoted or misrepresented while Governor.

Stevens has more than doubled the annual number of public speeches that Macfarlane gave in his last full year as Governor. If the last two months are anything to go by, Stevens will double his own record this year. His senior officers have also been considerably more active in terms of public appearances.

In a further break with the RBA’s secretive past, Governor Stevens has even put in an appearance on the Sunrise program. David Koch is not exactly Kerry O’Brien or Tony Jones, but the program’s reach is much greater. It sets an important precedent, but could be taken further. As I have argued previously, the RBA Governor should be made to front a media conference after every Board meeting and CPI release. A Treasurer with half a brain would insist on it.

The Governor’s comments on house prices during the program were somewhat risky, in that they could easily give the impression that house prices are a target rather than merely one of many indicators for monetary policy. If the public think Stevens is targeting house prices, then the Bank will end up owning them (figuratively, not literally, as with the US Fed). A better strategy would be to go on highlighting the supply-side constraints on the housing market. The public is smart enough to figure out who is to blame for those.

posted on 29 March 2010 by skirchner in Economics, Financial Markets, Monetary Policy

(2) Comments | Permalink | Main

I often accuse Australia’s regulation of foreign direct investment as having disturbing parallels with China’s regulatory environment. I was amused therefore to see the following headline:

China to Set Up Foreign Investment Review Board:

“The new agency will work independently of the current anti-monopoly investigation system,” the above source revealed.

Stating that the Ministry of Commerce’s anti-monopoly review of foreign mergers and acquisitions is only focused on the level of influence that certain mergers and acquisitions may have on competition, not on national nor industrial security.

As for the approval process under any possible future foreign investment review board, “[The process] will basically be the same as before, we are merely adding one extra procedure.”

posted on 29 March 2010 by skirchner in Economics, Foreign Investment

(4) Comments | Permalink | Main

A big f’ing deal indeed. While on the subject of fiscal train wrecks, Greg Mankiw retrieves a Paul Krugman column from 2003.

posted on 25 March 2010 by skirchner

(0) Comments | Permalink | Main

1. Charles Calomiris on Greek debt default.

2. The mother of all bail-outs: Freddie and Fannie.

3. Eric Falkenstein on Gary Gorton and Michael Lewis.

4. Google takes on China…and Australia.

posted on 24 March 2010 by skirchner in Economics

(0) Comments | Permalink | Main

At least one journalist gets the irrelevance of bank interest rate margins when the Reserve Bank is explicitly targeting credit conditions:

This means that the Reserve Bank, rather than bank gouging, is effectively targeting and setting the interest rate charged to mortgage borrowers because this is what influences the demand for credit. If the 20-25 basis point increase in the banks’ net interest margin suddenly disappeared, the Reserve Bank would simply hike its cash rate by the same amount so as to return mortgage lending rates back toward their more normal 7 per cent-plus levels.

As Stutchbury notes, bank bashing is little more than an attempt by politicians to divert attention from the implications of their own policies for interest rates. At least one bank is privately telling its shareholders to brace for more political thuggery:

Westpac is under financial pressure to raise its interest rates but fears a political backlash, chief executive Gail Kelly has reportedly told a private shareholder briefing.

Mrs Kelly told the briefing political pressure from Canberra could make it tough for the bank to increase home and business loan interest rates ahead of the federal election, due later this year

Mrs Kelly might also care to explain to Westpac shareholders why it is donating money to political parties that are actively seeking to damage the bank’s franchise.

posted on 23 March 2010 by skirchner in Economics, Financial Markets, Monetary Policy

(1) Comments | Permalink | Main

Electronic Frontiers Australia has been campaigning for online civil liberties since 1994 and is currently on the frontline of the battle against the federal government’s internet filtering regime. They are currently conducting a fundraising drive and I hope IE readers will join me in making a donation. EFA Board members are not paid for their efforts, so you can be sure funds will be used for campaigning purposes.

posted on 22 March 2010 by skirchner in Media

(0) Comments | Permalink | Main

I pose the question in a review of two recently published biographies of Ayn Rand, forthcoming in the Autumn issue of Policy.

posted on 20 March 2010 by skirchner in Rand

(0) Comments | Permalink | Main

Eric Falkenstein’s devastating takedown of Nobel crank Joe Stiglitz:

A nice thing about being a Nobel prize winner in economics is when you write books with the same policy recommendations, but use inconsistent arguments in each book, you still get the front table at Barnes and Noble.

Read the rest.

posted on 18 March 2010 by skirchner in Economics

(0) Comments | Permalink | Main

The RBA’s submission to the 16th Series CPI Review makes some familiar recommendations.

posted on 17 March 2010 by skirchner

(0) Comments | Permalink | Main

1. Reporters without Borders names Australia as an enemy of the Internet. See also Chinese learnings from Lu Kewen Thought.

2. Bond funds over-weight the worst of the worst.

3. Zero-bound smackdown.

4. Myths about Chinese purchases of US Treasuries.

5. ALP hopeful supports lower corporate tax rates.

6. Yours truly on the costs of fiscal stimulus.

posted on 17 March 2010 by skirchner in Economics

(0) Comments | Permalink | Main

Robert Shiller’s stock market advice is as useful as Steve Keen’s real estate advice:

Following Bob Shiller’s “over 20” rule would have kept you out of the stock market every single month from December 1992 to September 2008. All that time Shiller was presumably scolding investors, warning that “sooner or later” there would be a market downturn…

The permabears might make a plausible argument against buying stocks if they argued that a big spike in bond yields was imminent. But that would be inconsistent with their usual forecast of stagnation and deflation. So they’re still peddling the fallacy of “above average” multiples, as they were a year ago.

For the press to still be recycling Robert Shiller’s stale arguments against buying stocks in March 2009, despite what happened since, is a remarkable example of the media’s inclination to favor downbeat theories over any actual good news.

But as I note in my review of two of Shiller’s books, Bob has trouble staying on message when it comes to long-term investment advice:

Akerlof and Shiller…note in passing that ‘there has been one way, at least in the past, in which almost everyone could become at least moderately rich. Save a lot of money. Invest it for the long term in the stock market, where the rate of return after adjustment for inflation has been 7% per year’. This is not what Shiller was telling people in 1996 when he said that ‘long run investors should stay out of the market for the next decade’.

posted on 16 March 2010 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

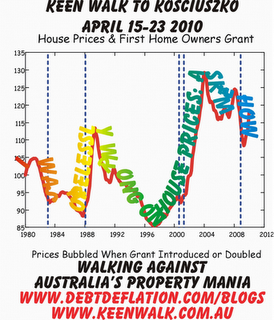

Steve Keen’s design for a t-shirt to wear on the march of his housing doomsday cult to the top of Mount Kosciuszko looks like a CAPTCHA challenge-response test:

As Chris Joye notes, the proposed design ‘directly dishonours the agreement he struck with Macquarie Bank’s Rory Robertson’ to wear a t-shirt that read ‘I was hopelessly wrong on house prices. Ask me how’.

posted on 13 March 2010 by skirchner in Economics, Financial Markets, House Prices

(1) Comments | Permalink | Main

Der Spiegel on the official lies that underpin European Monetary Union:

Since joining the euro zone, the 16 euro countries have violated the deficit rule, under which net new debt cannot exceed 3 percent of GDP, 43 times. Most of the infractions have occurred in the last two years. Greece is at the top of the list of violators. Only once did the country manage to push its deficit rate below the magic limit, and only with an extremely creative trick: The Greeks sugarcoated their statistics by including prostitution, black-market trade and gambling in the calculation of economic output. As a result, GDP rose by a stunning 25 percent in 2006, and the deficit dropped to 2.9 percent.

While this is a remarkable story coming from Der Spiegel, the authors still can’t quite come to terms with giving up on the euro, suggesting that its problems could be solved through a common financial policy and an IMF-like European Monetary Fund. Still, as Anne Appbaum notes, opinion in Germany is shifting.

posted on 12 March 2010 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

1. Roubini wrong again and again.

2. Cash for Corfu.

3. Axel Weber and Philipp Hildebrand versus Olivier Blanchard. See also Phil Lowe for further Blanchard repudiation.

4. Bill Emmott and Wolfgang Munchau as bumptious prats.

5. Hayek’s lessons for Kevin Rudd.

posted on 10 March 2010 by skirchner in Economics, Misc

(9) Comments | Permalink | Main

Governments may sometimes feel threatened by hedge funds (and properly so), but no one beats the US Justice Department when it comes to bureaucratic intimidation and standover tactics:

The Justice Department has launched an investigation into whether hedge funds might have banded together to drive down the value of the euro, people familiar with the matter say.

In a letter last week, the department has asked hedge funds including SAC Capital Advisors LP, Greenlight Capital Inc., Soros Fund Management LLC and Paulson & Co. to retain trading records and emails relating to the euro, say people who have seen the letter.

The letter was dated Feb. 26, the same day a page-one article in The Wall Street Journal outlined a large bet being made in recent weeks by heavyweight hedge funds against the euro, in moves that are reminiscent of the trading action at the height of the financial crisis like bets against Lehman Brothers and other troubled firms…

The Justice Department’s letter said the antitrust division “has opened an investigation into agreements among various hedge funds that trade euro contracts,” including contracts to trade euros in the “cash or the derivatives market,” a person familiar with the matter says.

The letter requested that the funds “preserve all documents” and electronic communications relating to agreements to trade the euro or communications about agreements to trade currencies, the person says.

As the article notes, the US authorities have a dismal track record in bringing successful prosecutions in these matters, suggesting that bureaucratic intimidation has become an end in itself.

posted on 04 March 2010 by skirchner in Economics, Financial Markets, Rule of Law

(1) Comments | Permalink | Main

Peter Wallison on why financial sector reform is stalled.

Electronic Frontiers Australia on Facebook police.

The documentary that asks why parents aren’t rioting in the streets.

posted on 03 March 2010 by skirchner in Misc

(0) Comments | Permalink | Main

Someone was betting big on the outcome of today’s RBA Board meeting:

a Centrebet regular, has staked just short of $30,000 on the Reserve Bank sitting on its hands.

If at 2.30pm the bank announces its board has decided to keep rates on hold, he will walk away with a profit of $21,000. If it puts rates up, he will say goodbye to $29,500.

‘‘He is very confident. He placed four separate bets, continuing to pile in as the odds went down,’’ said Centrebet’s Neil Evans.

‘‘Another punter staked $5000 on there being no change, another $3500.

‘‘It’s the house against the punters. I am hoping they don’t know something I don’t.’‘

They didn’t.

posted on 02 March 2010 by skirchner in Economics, Financial Markets, Monetary Policy

(6) Comments | Permalink | Main

I have an op-ed in today’s Canberra Times arguing for a monthly CPI for Australia (full text below the fold):

This lack of timeliness in compiling and releasing inflation data gives monetary policy a backward-looking bias. Around 45 per cent of the changes in the official interest rate since 1990 have been announced at the Board meeting immediately following the quarterly CPI release. During the 2002-08 tightening episode, 67 per cent of rate hikes followed this pattern, including every one of the six tightenings between May 2006 and February 2008.

Today saw the release of the TD Securities-Melbourne Institute Monthly Inflation Gauge, which rose by 0.1% in February, following a 0.8% rise in January and a 0.3% rise in December 2009. In the twelve months to February, the Inflation Gauge rose by 1.9%. The trimmed mean measure rose by 0.1%, to be 2.0% higher than a year ago. The gauge points to a 1% rise in the March quarter CPI for an annual rate of 3%.

As I note in the op-ed, the Melbourne Institute has stopped publishing the index numbers for the gauge, limiting its usefulness and going very much against the spirit of its creators and sponsors. However, for those who need it, Annette Beacher advises the index number for February is 123.45.

continue reading

posted on 01 March 2010 by skirchner in Economics, Financial Markets, Monetary Policy

(0) Comments | Permalink | Main

|