The Dodd Bill and Crony Capitalism

Cliffford Asness and Aaron Brown on the rise of the Treasury-financial complex:

The Dodd bill is perfectly designed to create the largest and most powerful crony system in history. It’s not that the people, regulator or regulated, are personally corrupt. It’s that the system will itself select for, reward and enforce corruption.

No financial professional will be able to turn down a “request” for a campaign contribution, and all financial institutions will hire former staffers as advisers or directors. No regulator can afford to antagonize a potential future employer. Regulators themselves must kowtow to Congress, which can use them for under-the table subsidies to favored groups. None of this is new to politics, of course, but the scale and lack of defined powers are.

posted on 15 May 2010 by skirchner in Economics, Financial Markets, Rule of Law

(0) Comments | Permalink | Main

Bernard Keane Wrong on Tax Expenditures

Writing in Crikey, Bernard Keane says:

Every year the government forgoes more than $100 billion in tax revenue courtesy of exemptions and concessions in the tax system.

This is an all-too-common journalistic error that stems from a misreading (or failure to read) the Treasury’s Tax Expenditures Statement. Here is how Treasury describes its methodology:

The estimates of tax expenditures in this statement are prepared under the ‘revenue forgone’ approach which calculates the value of tax expenditures in terms of the benefit to the taxpayer of the tax provisions concerned…

Revenue forgone estimates differ from budget revenue estimates because they are estimated relative to different benchmarks…It does not necessarily follow that there would be an equivalent increase to government revenue from the abolition of the tax expenditure.

the revenue forgone approach requires only a single consistent assumption regarding behavioural responses to removing a concession (no behavioural change) which allows the value of a tax concession to be based on the actual (or projected) level of transactions.

The critical assumption of no behavioural change invalidates Keane’s inferences about the implications of various tax expenditures for budget revenue.

posted on 14 May 2010 by skirchner in Economics, Fiscal Policy

(0) Comments | Permalink | Main

Nassim Taleb’s DIY Black Swan Event

From the WSJ:

The working theory among traders and others involved in the exchange meltdown is that the “Black Swan”-linked fund may have contributed to a “Black Swan” moment, a rare, unforeseen event that can have devastating consequences.

As Eric Falkenstein notes, this episode may shed light on how Nassim Taleb really makes his money:

All the while, however, he makes huge fees, because 1% on $4B is a lot of money, and his wealth will serve as proof that he’s an investing genius. More importantly, he then selectively presents to a credulous press he makes billions off his market savvy.

Gee, someone should write a book about blow-hard traders who misrepresent their track records and take excessive risk with other-people’s money, all due to cognitive biases they are too shallow to notice in themselves. Oh yeah, Taleb has done that! I guess his insider status gives him better insight.

posted on 14 May 2010 by skirchner in Economics, Financial Markets

(1) Comments | Permalink | Main

Yet Another New Tax on NSW Housing

The NSW government has introduced yet another new tax on housing transactions. Yesterday, I gave a post-budget presentation to a business group in Western Sydney, together with Westpac’s Matthew Hassan. Matthew presented some stunning charts showing the growth in the tax burden on housing in each state, with NSW the clear winner. Indeed, the tax burden on a new house and land package on Sydney’s suburban fringe is now such as to make it unprofitable to bring to market, which helps explain why new housing supply in the state is running at 1950s levels.

If only some of the outrage directed against negative gearing and capital gains tax concessions by ignorant journalists and commentators could be marshalled against the taxes and charges that are really responsible for putting upward pressure on house prices.

posted on 13 May 2010 by skirchner in Economics, House Prices

(4) Comments | Permalink | Main

How to Reduce the Budget Deficit, Without Really Trying

According to Treasurer Wayne Swan, the government is set to preside over the ‘most substantial fiscal consolidation in Australia’s modern history’, leading the federal budget back into surplus by 2012-13. The OECD’s glossary of statistical terms defines fiscal consolidation as ‘a policy aimed at reducing government deficits and debt’. But the policy measures in the government’s 2010-11 Budget make the budget balance worse, not better. The projected improvement in the budget bottom line is more than fully accounted for by changes in forecasting assumptions. The government wants to claim credit for an improvement in the budget outlook that is entirely a product of its earlier forecasting errors.

The government’s forecast of a faster return to surplus is not evidence of fiscal discipline, but of the sensitivity of the fiscal outlook to underlying assumptions. Similarly, the claim that the Australian economy performed better than expected through the global financial crisis is evidence, not of the success of activist fiscal policy, but the fact that the forecasts on which that policy was based were too pessimistic.

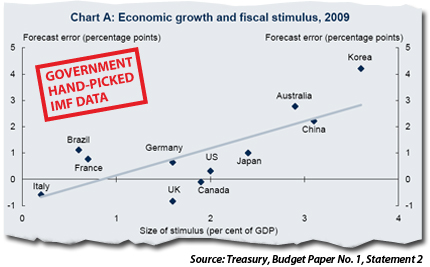

The budget papers include a chart showing that the size of fiscal stimulus was positively correlated with the size of the forecast error for economic growth across 11 countries. The government wants us to conclude that its fiscal stimulus is to be credited with better than expected economic performance. But causality could just as easily run the other way: the large forecasting error led to excessive stimulus. Since the government’s earlier budget forecasts already had the expected impact of the stimulus measures built into them, its assumptions about the effectiveness of stimulus must have been incorrect as well. Indeed, the government now claims that the multipliers it used to estimate the impact of the stimulus were too small. But this just concedes the point that the government has no idea how effective its fiscal policy measures really were in stimulating economic activity.

What matters is the not the budget forecasts, but the policy outcomes. The Rudd government has presided over the biggest growth in federal spending since Gough Whitlam. It is now committed to keeping real growth in federal spending below 2%. But that’s just a forecast. As the old disclaimer says, outcomes may vary.

UPDATE: Sinclair Davidson includes the data Treasury could have used, but didn’t:

posted on 12 May 2010 by skirchner in Economics, Fiscal Policy

(0) Comments | Permalink | Main

Population Growth and Capacity Constraints

I have an op-ed in today’s Australian on the issue of population growth and capacity constraints:

Much of the debate has been predicated on the mistaken view that population growth and immigration policy should be conditioned on existing capacity constraints, whether it be in the areas of housing, infrastructure, water or the environment. Taken to their logical extreme, many of these concerns would have ruled out the founding of the colony of NSW in 1788, when the infrastructure to support the first European settlers was nonexistent.

A growing population adds to demand for existing resources but also supplies the incentives and additional human capital essential to overcoming temporary resource constraints.

Yes, this is the same op-ed that ran in the Canberra Times some time ago. It got another run as a result of an error made at the Oz. Not that I’m complaining, but we don’t generally make a practice of double-dipping on op-eds.

posted on 12 May 2010 by skirchner in Economics, Population & Migration

(0) Comments | Permalink | Main

The EMH Following the Mother of All Typos

Phil Levy on the return of efficient markets:

One of the great memes to emerge from the financial crisis was that economists had no idea what they were talking about. After all, professional economists had urged deregulation and faith in markets; an internet full of amateur economists could easily see that such misguided nuggets of advice were solely responsible for all the woe that ensued.

This analysis was always a bit problematic. First, we may need a bit more perspective to properly attribute causality in the crisis. The snap analyses have been politically convenient, in that they have supported snap policy responses, but they have their flaws. For example, what about Fannie Mae and Freddie Mac? These were hardly paragons of unfettered market extremism and they were central to the housing bubble and to the cost of the eventual government bailout. I know firsthand that this was a crisis foretold by economists, since I served as a senior staff economist for Greg Mankiw when he chaired President Bush’s Council of Economic Advisers. Greg, working with excellent economists like Karen Dynan, now of Brookings, was vocal about the dangers posed by these government-sponsored enterprises and helped formulate proposals for reining them in. Congress blocked the proposals.

posted on 08 May 2010 by skirchner in Economics, Financial Markets

(0) Comments | Permalink | Main

The US Housing ‘Bubble’ that Wasn’t

Some refreshing ‘bubble’ scepticism from Casey Mulligan:

Adjusted for inflation, residential property values were still higher at the end of 2009 than 10 years ago. This fact raises the possibility that at least part of the housing boom was an efficient response to market fundamentals.

posted on 07 May 2010 by skirchner in Economics, House Prices

(0) Comments | Permalink | Main

Abusing the 2004 FOMC Minutes

Vince Reinhart on the abuse of the March 2004 FOMC minutes to attack Alan Greenspan:

Greenspan was noting that letting the world know that top Fed officials were considering an issue would draw attention to that issue, which might sometimes be uncomfortable. This is a debatable proposition, to be sure, but not one that sounds conspiratorial.

That is, unless you have the imagination of Ryan Grim, who linked this obviously general discussion of the timing of the release of the minutes to the specific mention of housing prices 45 pages (and four hours in real time) earlier. To do so, Grim also had to elevate a mention about real-estate speculation by the president of the Federal Reserve Bank of Atlanta, Jack Guynn, into Cassandra’s warning.

posted on 05 May 2010 by skirchner in Economics, Monetary Policy

(0) Comments | Permalink | Main

The Market Believes the RBA is Targeting House Prices

The weighted average of capital city established house prices rose a Steve Keen-busting 4.8% q/q and 20% y/y for the March quarter, with gains in Sydney and Melbourne in excess of 20% y/y. This saw three-year bond futures savaged by around 7 basis points and the implied probability of a 25 basis points tightening from the RBA tomorrow surge from around 50% to around 65% on iPredict. The ugly 3.4% annualised result for the trimmed mean of the TD-MI inflation gauge released an hour earlier should be more important for the RBA’s deliberations, but it is house prices that are grabbing the market’s attention.

posted on 03 May 2010 by skirchner in Economics, Financial Markets, House Prices, Monetary Policy

(1) Comments | Permalink | Main

The RBA’s Perception Problem

Regardless of whether the RBA still backgrounds journalists on the monetary policy outlook, the perception that it does so remains alive and well in financial markets. Yesterday’s column by Terry McCrann confidently declared that ‘the Reserve Bank is all-but certain to deliver its third successive interest rate increase next Tuesday.’ At the same time, the implied probability of a 25 bp tightening priced into inter-bank futures rose from around 32% Wednesday to around 48% Thursday. There was a similar increase in the probability of a tightening on iPredict.

This suggests that the market doesn’t believe RBA Governor Glenn Stevens’ denial that the RBA leaks, although that denial was couched in very narrow terms. Of course, current pricing also implies that the market doesn’t have complete confidence in Terry McCrann either, but the change in market pricing is still significant.

Chris Joye speculates that this might be part of a RBA sting operation designed to finally put to rest the idea that the RBA leaks. Yet even if the punditocracy is deliberately wrong-footed on this occasion, it may not be enough to change market perceptions. When I worked in financial markets, I was often asked by clients whether I had ‘contacts’ at the RBA, with the clear implication that anyone who did was more likely to have the inside running on monetary policy. I always thought these clients had a greatly exaggerated view of the extent to which any such contacts might be useful in calling the interest rate outlook and the amount of media and other backgrounding that actually takes place. But that perception, even if exaggerated, is still a problem for the integrity of monetary policy.

UPDATE: Friday’s Reuters poll has the median financial market economist giving a 60% chance to a 25 bp tightening on Tuesday. Not quite the ‘all-but’ certainty expressed by McCrann.

posted on 30 April 2010 by skirchner in Economics, Financial Markets, Monetary Policy

(2) Comments | Permalink | Main

Why the Financial Reform Bill Will Help Rather than Hinder Goldmans

The always insightful Eric Falkenstein:

Blankfein is a crony capitalist, begging for more ‘regulation’ because he knows that a 1300 page bill basically only helps those with connections and extant massive legal infrastructure, and hurts potential competitors who merely have good ideas

posted on 29 April 2010 by skirchner in Economics, Financial Markets, Rule of Law

(0) Comments | Permalink | Main

Three Wasted Years

Former federal Labor minister Gary Johns on three wasted years of government:

a government without purpose roams the stage with nothing to show and looks to pick a fight or blame others, in this case state governments for allegedly choking the hospitals.

The Department of Prime Minister and Cabinet is overwhelmed by constant requests from the Prime Minister’s office for new and better schemes and promotions and photo opportunities. There is no agenda, no priority setting and no point at all except to get Rudd on the front page…

The electoral timidity, the profligacy, the spin, the lack of reason, the internal bullying, the vast waste of money, the interminable photos with children, the transparent use of religion with the photos at church on Sunday, have all embittered his already unimpressed caucus colleagues.

posted on 29 April 2010 by skirchner in Economics, Politics

(0) Comments | Permalink | Main

Don’t Blame Migrants for Home Grown Problems

I had an op-ed in yesterday’s Canberra Times (‘Migrants add to growth hopes’) arguing that politicians are using migrants as scapegoats for the many public policy problems they have been unwilling or unable to tackle themselves. No link, but full text below the fold (text may differ slightly from published version).

The highly readable Chris Berg made similar arguments in a piece for ABC The Drum Unleashed.

continue reading

posted on 27 April 2010 by skirchner in Economics, Population & Migration

(5) Comments | Permalink | Main

The Fix is In

In a previous post, I warned that:

The danger now is that the government implements another of its short-term political fixes ahead of this year’s federal election and re-tightens the rules [on foreign direct investment in residential property] rather than addressing the supply-side constraints besetting Australian residential property.

In the event, we have this:

FEDERAL and state governments have commissioned a working party of officials to hold a no-stone-unturned inquiry into all factors contributing to record house prices, as Labor senses the issue is becoming a political danger.

The inquiry, to deliver its first report within weeks, will examine sensitive areas such as tax breaks for negative gearing, land banking by developers, and whether grants to first home buyers push up house prices.

More wide-ranging than I expected, but also a waste of time, something the government is fast running out of ahead of this year’s federal election. As Christopher Joye notes, these issues have already been extensively studied and the policy solutions are well-known. The likely outcome is a short-term political fix designed to serve as a holding action ahead of the election. Do we really need an inquiry into whether grants to first home buyers push up house prices? Even Steve Keen and I agree on that. Did we really need a review by a former senior public servant to tell us that the home insulation program was a waste?

While the Prime Minister has an underserved reputation as a policy wonk, the reality is that he is what former Prime Minister Paul Keating would call a ‘policy bum’.

posted on 23 April 2010 by skirchner in Economics, House Prices

(4) Comments | Permalink | Main

Page 25 of 97 pages ‹ First < 23 24 25 26 27 > Last ›

|